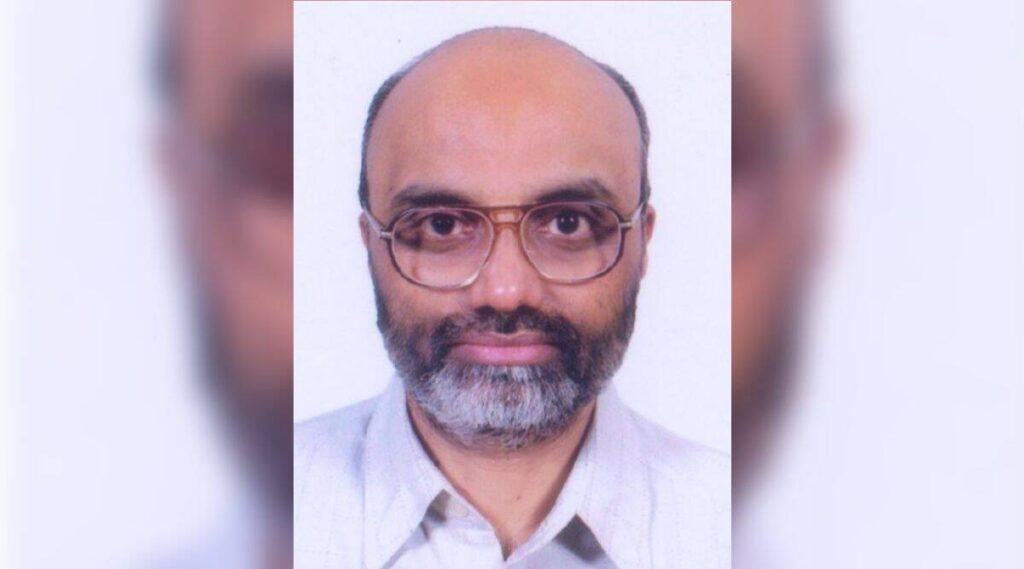

A powerful votary of tight financial coverage, JAYANTH R VARMA, member of the Reserve Financial institution’s Financial Coverage Committee, had stated “the coverage panel ought to cease specializing in additional tightening of repo charge and take a pause for now” within the final MPC assembly. Varma, Professor of Finance and Accounting, IIM, Ahmedabad, who spoke to GEORGE MATHEW, stated, “no matter we now have finished or might do in 2022 can solely convey inflation down in mid-2023.”

Now that inflation has hit 7.4 per cent, do you assume MPC has didn’t examine the retail inflation within the nation?

There isn’t a query that inflation has been unacceptably excessive for unacceptably lengthy. Inflation has additionally been above 6 per cent for 3 consecutive quarters which is the statutory definition of failure. I don’t want to present any excuses or justification for this unlucky scenario. Nevertheless, it is very important observe the explanations which have prompted this drawback. First, the MPC consciously (and I believe appropriately) prioritized financial restoration over inflation through the pandemic. Second, for my part, we persevered on this longer than we must always have; normalization may have begun in mid-2021 when the pandemic had mutated right into a well being tragedy as an alternative of an financial tragedy. Third, the provision disruptions from the Ukraine battle created an surprising inflationary shock that hit us earlier than the MPC had normalized the financial coverage.

You had talked about that the MPC ought to cease specializing in additional tightening of repo charge and take a pause for now. Are you able to clarify the rationale for this view as inflation is but to return down? Do you continue to maintain this view?

The September inflation print of seven.4 per cent was alongside anticipated strains. No affordable motion that the MPC may have taken in mid-2022 would have been in a position to cut back this quantity, as a result of financial coverage acts with lengthy lags. The total impact takes about 5-6 quarters. The implication is that the one strategy to forestall 7 per cent inflation immediately would have been by aggressive tightening within the second half of 2021. Since we didn’t normalize rates of interest until early 2022, we had already missed the bus when the Ukraine battle began. No matter we now have finished or might do in 2022 can solely convey inflation down in mid-2023.

You appear to have diluted your earlier stance of robust coverage motion and statements in opposition to withdrawal of lodging. Do you agree?

I’ve all alongside argued for early motion and never for robust motion. The truth is, the aim of early motion is to keep away from taking aggressive motion later. As I wrote in my assertion in August final yr (14 months in the past): “Straightforward cash immediately may result in excessive rates of interest tomorrow.” I’m glad that the MPC resorted to front-loaded charge hikes in 2022, and I consider that this aggressive motion has opened up the window to pause.

When do you assume the retail inflation will come all the way down to the RBI’s consolation stage of 4 per cent? Do you assume rising rates of interest will influence credit score offtake, investments and development within the nation?

Financial coverage dampens inflation by decreasing demand, and this essentially means an influence on investments and development. There isn’t a free lunch. We have to be very clear that aggressive tightening would impose an insupportable development sacrifice. The issue is that we now have nonetheless to return to the pre-pandemic pattern line, and we now have nonetheless not recovered from the expansion slowdown that started 4 or 5 years in the past. On this context, we have to convey inflation all the way down to round 5 per cent in a short time, after which let it glide in the direction of the 4 per cent goal in a fashion that avoids an insupportable development sacrifice.

US Fed and developed economies are anticipated to lift charges additional. How will India be impacted? There’s a view in some quarters that the rupee just isn’t sliding however the greenback is strengthening. What’s your view?

My view is that we’re witnessing a interval of greenback power and never rupee weak point. The greenback is rising in opposition to all main currencies in a fashion paying homage to the early Nineteen Eighties. That is a lot much less inflationary than rupee weak point as a result of a powerful greenback is traditionally related to dampening of greenback costs of crude oil and different commodities. The low greenback worth and the excessive worth of the greenback offset one another to an incredible extent resulting in much less stress on the rupee prices of commodities. The rising greenback might be painful for these Indian corporations which have giant unhedged greenback debt, however I believe Indian corporations have grow to be extra prudent after the bitter expertise of the worldwide monetary disaster.