A model of this story first appeared on TKer.co

Shares closed decrease final week with the S&P 500 falling 1.4%. The index is now up 13.3% yr thus far, up 21.6% from its October 12 closing low of three,577.03, and down 9.3% from its January 3, 2022 report closing excessive of 4,796.56.

In latest weeks, strategists throughout Wall Avenue have revised up their year-end targets for the S&P 500. These up to date calls incorporate the enhancing outlook for earnings, expectations for the Fed to quickly dial again hawkish financial coverage, and the truth that inventory costs have largely gone up for the reason that starting of the yr.

Some distinguished bears are nonetheless calling for a giant pullback in costs earlier than the yr’s over. They embody Morgan Stanley’s Michael Wilson, who has been reiterating his name for the S&P 500 to fall to three,900 by the tip of the yr, and Capital Economics’ Thomas Mathews, who just lately revised his goal up to just 4,000 from an preliminary goal of three,800.

Each of those strategists, nevertheless, have bullish issues to say about the long run.

Wilson, who expects S&P 500 earnings per share (EPS) to fall to $185 in 2023, predicts a “sharp rebound” in development with EPS surging 23% to a report $228 in 2024 and leaping one other 10% to $250 in 2025.

Wilson hasn’t but issued S&P value targets for the ends of these years, however Capital Economics Mathews’ has. They usually’re bullish.

Mathews predicts the S&P will explode to five,500 by the tip of 2024 and 6,500 by the tip of 2025. This could suggest a 37.5% surge assuming the index falls to 4,000 this yr, adopted by an 18.1% achieve in 2025.

From Mathews’ June 20 analysis be aware:

…By subsequent yr, we predict worries about development can be fading and, what’s extra, the Fed will most likely be in easing mode. That might create a backdrop for enthusiasm about equities – and AI particularly – to get well.The median rebound within the S&P 500 from a recession-induced hunch since 1960 is ~38%. The pretty gentle recession – and related fall within the S&P 500– we forecast would most likely argue for a smaller restoration than that median. But when we’re proper that it’ll come alongside a rekindling of AI enthusiasm as properly, the index may carry out fairly properly.

Now, there’s no assure we’ll see a recession within the coming months. Actually, economists have been dialing again their recession warnings in latest weeks.

That mentioned, it could definitely not be unprecedented to see huge returns within the inventory market following a recession.

Zooming out 🔭

Strategists’ short-term returns expectations for the S&P will usually vary from very optimistic to very unfavourable.

However long run, they have an inclination to skew positively. (In spite of everything, the inventory market normally goes up!)

It’s one thing for traders to recollect as they learn information articles and different publications that cite the analysis of Wall Avenue strategists. Generally, these consultants’ short-term predictions look very totally different from their long-term views.

Reviewing the macro crosscurrents 🔀

There have been a number of notable knowledge factors and macroeconomic developments from final week to contemplate:

🦅 Powell reiterates inflation battle isn’t over. From Federal Reserve Chair Jerome Powell’s look earlier than the Home Monetary Providers Committee: “Inflation has moderated considerably for the reason that center of final yr. Nonetheless, inflation pressures proceed to run excessive, and the method of getting inflation again right down to 2 p.c has an extended method to go.”

👍 The U.S. financial system is rising. From S&P International’s June Flash U.S. PMI report (by way of Notes): “The general charge of growth of enterprise exercise within the US remained sturdy in June, according to GDP rising at a charge of 1.7% to place second quarter development within the area of two%.”

undefined

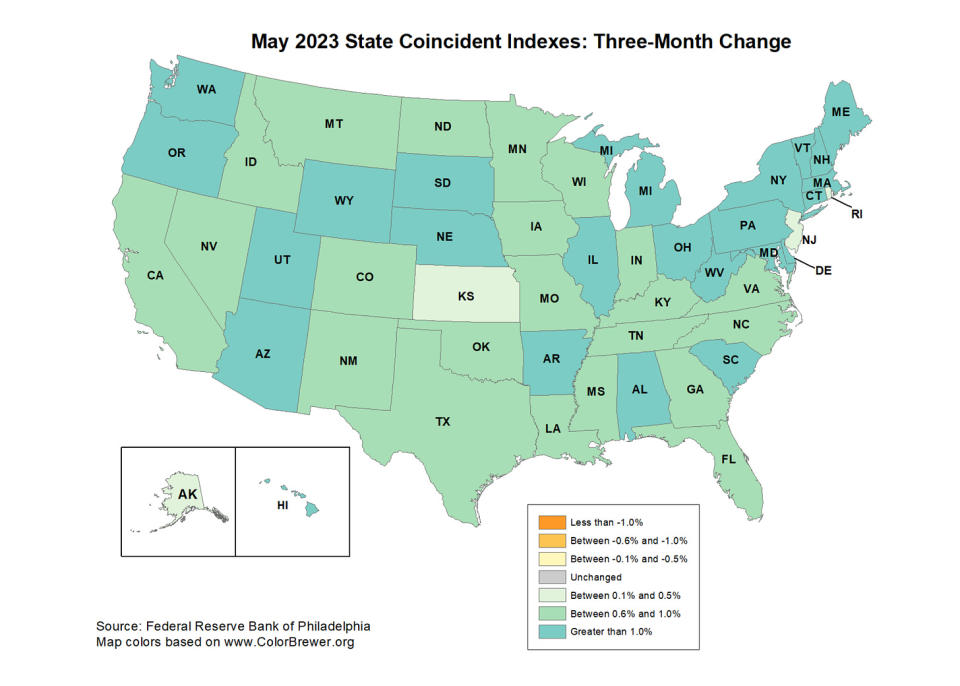

🇺🇸 All 50 states are rising. From the Philly Fed’s State Coincident Indexes

report: “Over the previous three months, the indexes elevated in all 50 states, for a three-month diffusion index of 100. Moreover, up to now month, the indexes elevated in 47 states, decreased in a single state, and remained secure in two, for a one-month diffusion index of 92.”

undefined

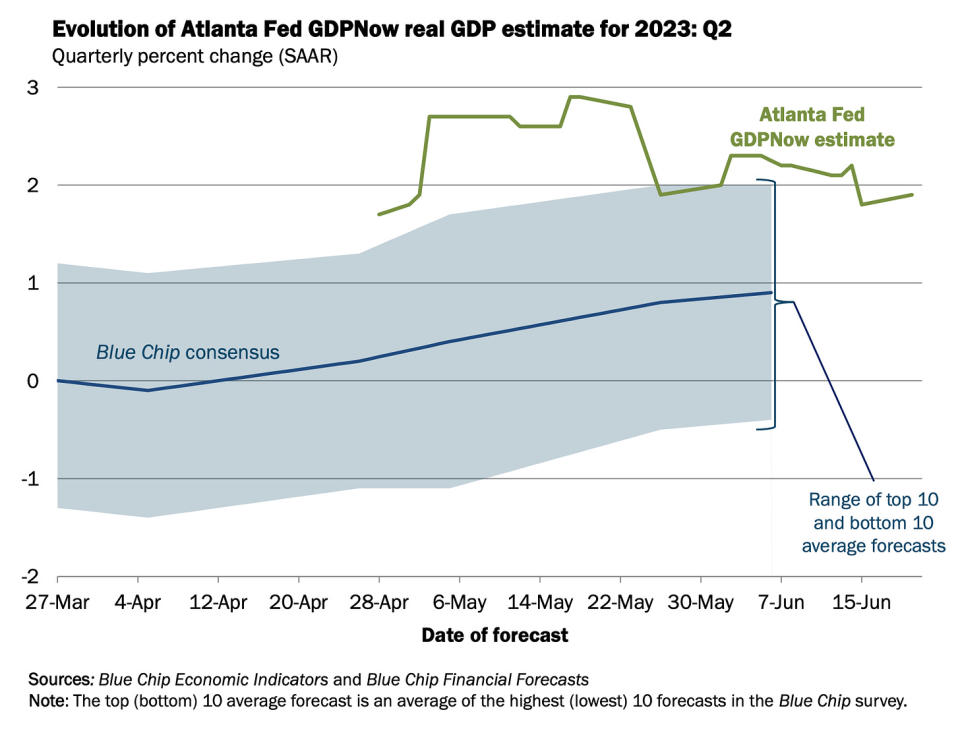

📈 Close to-term GDP development estimates stay optimistic. The Atlanta Fed’s GDPNow mannequin sees actual GDP development climbing at a 1.9% charge in Q2. Whereas the mannequin’s estimate is off its excessive, it’s however very optimistic and up from its preliminary estimate of 1.7% development as of April 28.

undefined

🏚 Dwelling gross sales tick up. Gross sales of beforehand owned houses climbed 0.2% in Might to an annualized charge of 4.30 million items. From NAR chief economist Lawrence Yun: “Mortgage charges closely affect the route of dwelling gross sales… Comparatively regular charges have led to a number of consecutive months of constant dwelling gross sales.”

“Accessible stock strongly impacts dwelling gross sales, too,” Yun added. “Newly constructed houses are promoting at a tempo paying homage to pre-pandemic instances due to plentiful stock in that sector. Nonetheless, existing-home gross sales exercise is down sizably because of the present provide being roughly half the extent of 2019.”

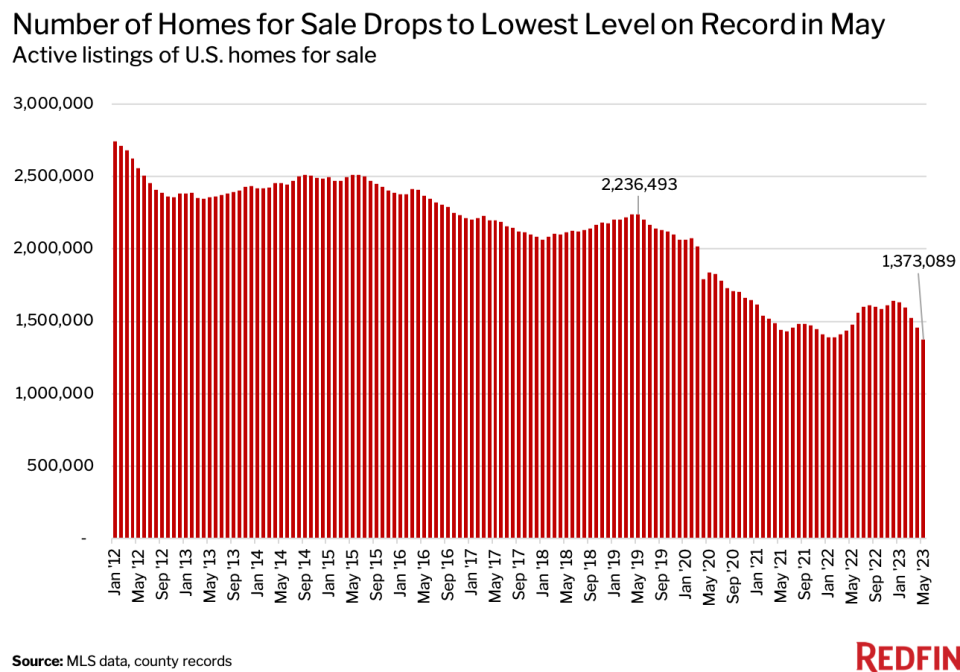

Certainly, in response to Redfin: “The variety of houses on the market within the U.S. fell 7.1% yr over yr to 1.4 million on a seasonally adjusted foundation in Might. That’s the bottom degree in Redfin’s information, which date again to 2012, and the primary annual decline since April 2022… “

undefined

Extra from Redfin: “America’s housing inventory is dwindling as a result of there are only a few folks promoting houses. New listings of houses on the market declined 25.2% yr over yr in Might to the third lowest degree on report on a seasonally adjusted foundation, as owners had been handcuffed by excessive mortgage charges. Almost each home-owner with a mortgage has an rate of interest beneath 6%, which means many are opting to remain put as a result of promoting and shopping for a brand new dwelling would imply taking over a better month-to-month mortgage cost.”

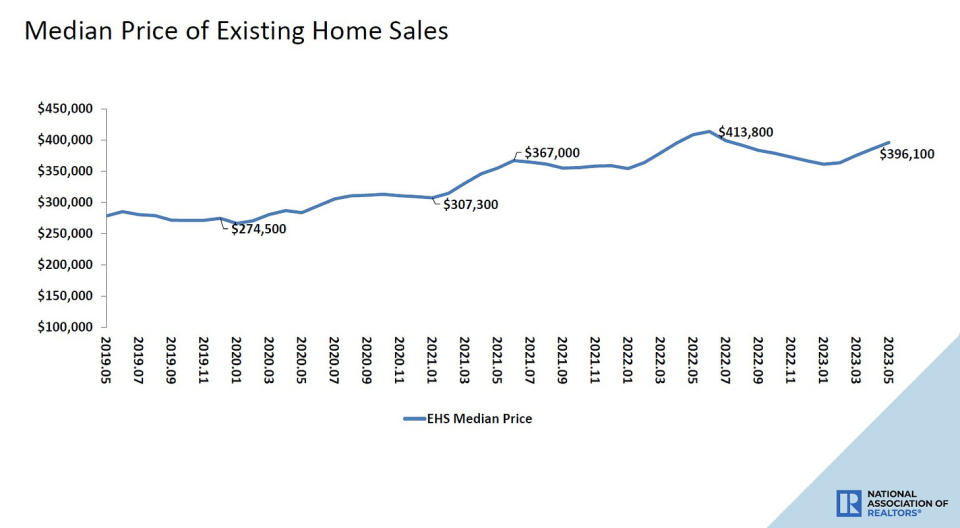

💸 Dwelling costs rise. Costs for beforehand owned houses rose month over month, however had been down from yr in the past ranges. From the NAR: “The median existing-home value for all housing sorts in Might was $396,100, a decline of three.1% from Might 2022 ($408,600). Costs grew within the Northeast and Midwest however fell within the South and West.”

🏠 Dwelling builder sentiment turns optimistic. From the NAHB (by way of Notes): “Stable demand, an absence of present stock and enhancing provide chain effectivity helped shift builder confidence into optimistic territory for the primary time in 11 months.”

From NAHB Chief Economist Robert Dietz: “A backside is forming for single-family dwelling constructing as builder sentiment continues to step by step rise from the start of the yr… The Federal Reserve nearing the tip of its tightening cycle can also be excellent news for future market situations when it comes to mortgage charges and the price of financing for builder and developer loans.”

🔨 New dwelling development surges. Housing begins jumped 21.7% in Might to an annualized charge of 1.63 million items, in response to the Census Bureau (by way of Notes). Constructing permits rose 5.2%% to an annualized charge of 1.49 million items.

undefined

From JPMorgan: “After weakening considerably final yr because the Fed launched into its aggressive mountain climbing cycle, most US housing knowledge not solely have stabilized this yr but in addition at the moment are displaying indicators of rebounding from latest lows. Yesterday’s NAHB dwelling builders’ sentiment measure jumped 5pts to an 11-month excessive of 55, with the most important transfer within the survey seen in anticipated single-family gross sales over the following six months. The mix of tight provide and up to date stability in mortgage charges — together with still-supportive client fundamentals from extra financial savings and sturdy employment development — seem like supporting the housing market regardless of alerts from the Fed that it isn’t but carried out tightening coverage.”

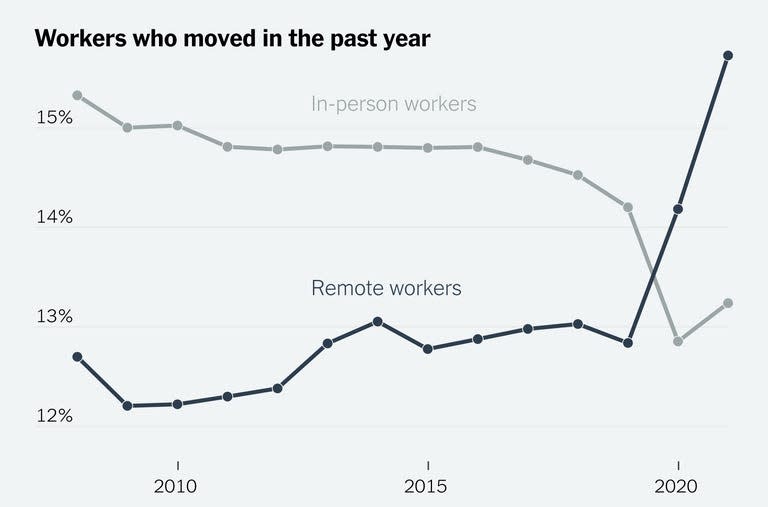

🚛 Distant staff usually tend to transfer. From the New York Occasions: “In the course of the pandemic, individuals who labored from dwelling turned considerably extra more likely to transfer — and extra seemingly to take action than all different staff… This rising mobility was pushed by distant staff who sought new housing of their identical metro areas, but in addition by a wave of distant staff decamping to different components of the nation. Within the first two years of the pandemic, one in 4 staff who moved long-distance was working remotely in a brand new dwelling — a beforehand unheard-of scale of distant migration.”

undefined

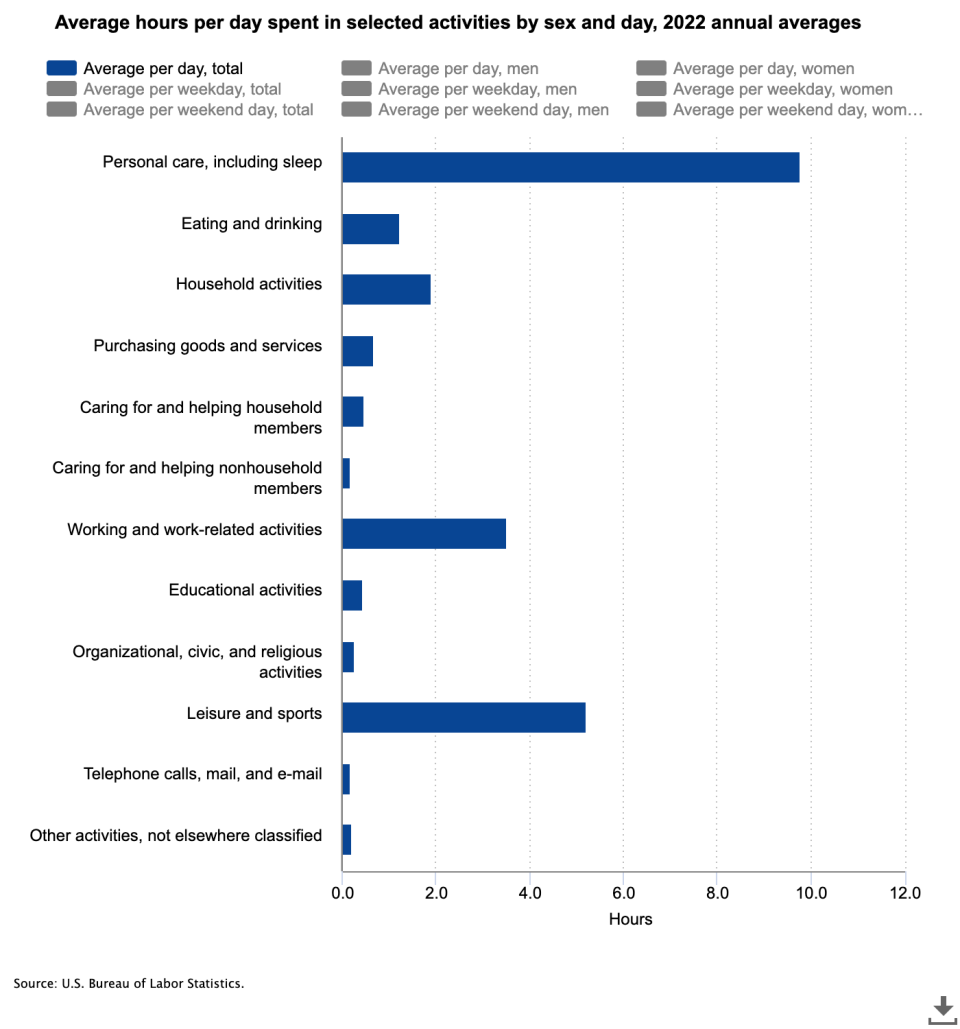

🕰️ How we cross the time. From the BLS:

undefined

💼 Unemployment claims tick up. Preliminary claims for unemployment advantages stood at 264,000 in the course of the week ending June 17, unchanged from the week prior. Whereas that is up from the September low of 182,000, it continues to pattern at ranges related to financial development.

undefined

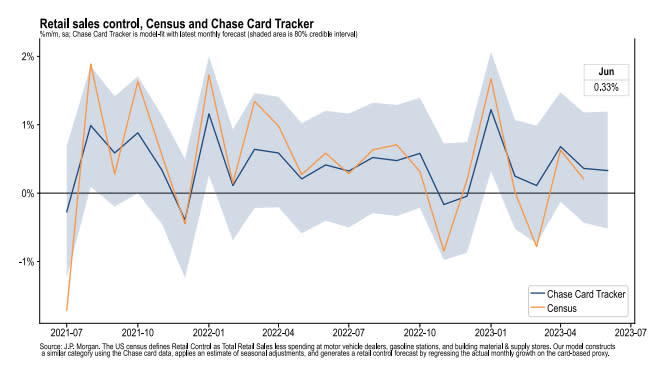

💳 Card spending smooth however secure. From JPMorgan Chase: “As of 18 Jun 2023, our Chase Client Card spending knowledge (unadjusted) was 1.1% above the identical day final yr. Primarily based on the Chase Client Card knowledge by way of 18 Jun 2023, our estimate of the US Census June management measure of retail gross sales m/m is 0.33%.”

undefined

Placing all of it collectively 🤔

We proceed to get proof that we may see a bullish “Goldilocks” smooth touchdown state of affairs the place inflation cools to manageable ranges with out the financial system having to sink into recession.

The Federal Reserve just lately adopted a much less hawkish tone, acknowledging on February 1 that “for the primary time that the disinflationary course of has began.” On Might 3, the Fed signaled that the tip of rate of interest hikes could also be right here. And at its June 14 coverage assembly, it saved charges unchanged, ending a streak of 10 consecutive charge hikes.

In any case, inflation nonetheless has to come back down extra earlier than the Fed is snug with value ranges. So we should always count on the central financial institution to maintain financial coverage tight, which implies we ought to be ready for tight monetary situations (e.g. larger rates of interest, tighter lending requirements, and decrease inventory valuations) to linger.

All of this implies financial coverage can be unfriendly to markets in the intervening time, and the chance the financial system sinks right into a recession can be comparatively elevated.

However, we additionally know that shares are discounting mechanisms, which means that costs could have bottomed earlier than the Fed alerts a significant pivot in financial coverage.

Additionally, it’s essential to keep in mind that whereas recession dangers are elevated, shoppers are coming from a really robust monetary place. Unemployed persons are getting jobs. These with jobs are getting raises. And lots of nonetheless have extra financial savings to faucet into. Certainly, robust spending knowledge confirms this monetary resilience. So it’s too early to sound the alarm from a consumption perspective.

At this level, any downturn is unlikely to show into financial calamity on condition that the monetary well being of shoppers and companies stays very robust.

And as at all times, long-term traders ought to keep in mind that recessions and bear markets are simply a part of the deal if you enter the inventory market with the intention of producing long-term returns. Whereas markets have had a reasonably tough couple of years, the long-run outlook for shares stays optimistic.

A model of this story first appeared on TKer.co