ASML Holding (NASDAQ: ASML) is a essential participant within the semiconductor trade, as chipmakers and foundries use its gear to fabricate chips. That explains why the Dutch semiconductor gear big has clocked spectacular beneficial properties on the inventory market previously 5 years.

The strong demand for ASML’s chipmaking gear to satisfy the rising want for semiconductors has led to a pleasant soar in its income and earnings, as seen within the previous chart. The great half is that ASML appears constructed for extra development over the following 5 years, because the demand for its choices stays strong amid the substitute intelligence (AI) growth. This grew to become evident from the corporate’s outcomes for the second quarter of 2024, launched on July 17.

Let’s take a more in-depth have a look at ASML’s newest quarterly efficiency and examine why traders can anticipate extra upside on this semiconductor inventory over the following 5 years.

ASML sees huge enhance in bookings however traders nonetheless hit the panic button

All eyes have been on the bookings ASML obtained within the second quarter, and that determine of 5.6 billion euros was effectively forward of analysts’ expectations of 4.41 billion euros. ASML’s bookings stood at 4.5 billion euros in the identical quarter final 12 months and three.6 billion euros within the first quarter of 2024.

So the corporate’s order guide elevated properly final quarter, each sequentially and on a year-over-year foundation. It is price noting that ASML obtained 2.5 billion euros’ price of orders for its excessive ultraviolet (EUV) lithography machines final quarter, accounting for nearly half of its whole orders for the interval.

These EUV machines are used for making superior chips primarily based on smaller course of nodes, that are able to delivering excessive computing energy whereas consuming much less electrical energy. Foundries and chipmakers are utilizing these EUV machines to churn out AI chips, which explains why its EUV bookings elevated by 56% on a year-over-year foundation, contributing to a large backlog price 39 billion euros.

Nonetheless, traders pressed the panic button following ASML’s outcomes for a few causes and the inventory fell 12%. First, the corporate’s income outlook of seven billion euros for the present quarter is decrease than the Road estimate of seven.5 billion euros. Second, considerations about restrictions on ASML’s gross sales to China have additionally contributed to the sell-off in ASML inventory following its newest outcomes.

That is as a result of China accounted for nearly half of ASML’s prime line final quarter, and the demand for the latter’s older gear is robust in that nation. So reviews that the Biden administration is contemplating imposing stricter restrictions on gross sales of semiconductor expertise to China are weighing on ASML inventory.

Buyers should not miss the larger image

Buyers would do effectively to try the broader image, because the wholesome demand for AI chips over the following 5 years ought to permit ASML to beat any potential lack of enterprise in China ought to stricter sanctions be imposed. The worldwide AI chip market is predicted to generate $296 billion in income in 2030, rising at an annual fee of 33% throughout the forecast interval. This could create demand for extra EUV lithography gear.

In accordance with Market Digits, the EUV lithography market may generate $37 billion in income in 2030, in contrast with $9 billion final 12 months. ASML has a monopoly in EUV lithography machines, which implies that it’s set to get pleasure from strong incremental income development as this market expands in the long term.

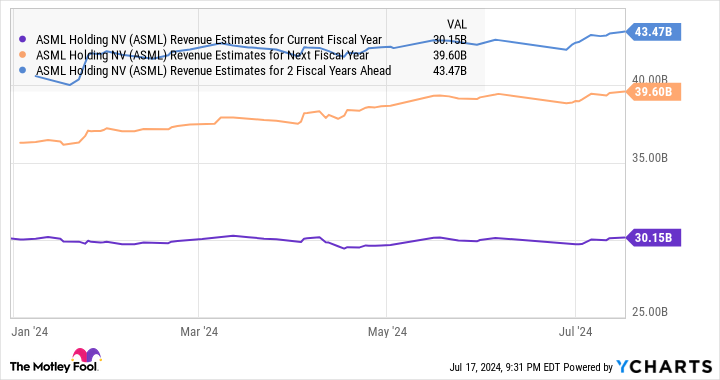

Furthermore, ASML is anticipating to return to development in 2025 following a flat income efficiency in 2024, pushed by the current restoration within the semiconductor market which is fueled by catalysts equivalent to AI. Analysts predict its prime line to extend 3% in 2024 to $30.2 billion, however the forecast for the following couple of years is kind of strong.

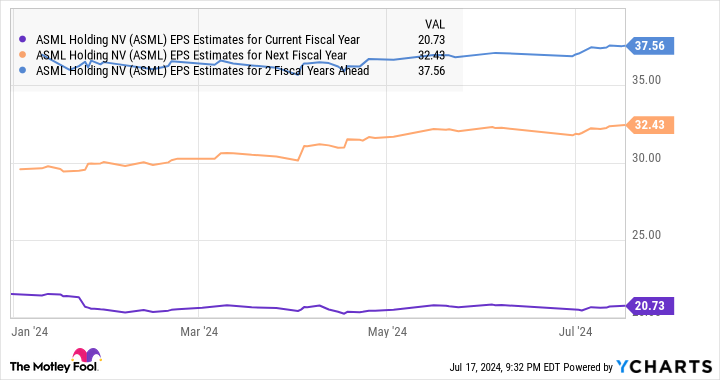

ASML ought to have the ability to maintain such wholesome development for an extended time contemplating the long-term alternative within the AI chip market. Analysts predict its earnings to extend at a compound annual development fee of 21% for the following 5 years. Nonetheless, ASML’s earnings are anticipated to develop at a a lot sooner tempo in 2025 and 2026 following a small decline within the present 12 months from final 12 months’s ranges of $21.22 per share.

There is a good probability that ASML may develop at a sooner tempo than analysts’ expectations over the following 5 years on the again of AI-driven demand for its chipmaking gear, and that might lead the market to reward this AI inventory with wholesome beneficial properties. That is why traders would do effectively to capitalize on the drop in ASML inventory following its newest earnings report, because it may bounce again and soar greater in the long term because of the catalysts I’ve mentioned.

Do you have to make investments $1,000 in ASML proper now?

Before you purchase inventory in ASML, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and ASML wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $722,626!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 15, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ASML. The Motley Idiot has a disclosure coverage.

The place Will ASML Holding Inventory Be in 5 Years? was initially revealed by The Motley Idiot