Within the final 5 years, shares of Celsius Holdings (NASDAQ: CELH) are up 6,290%. Meaning for each $1,000 somebody invested in Celsius 5 years in the past, it’s value over $60,000 immediately. Not dangerous. The proprietor of the Celsius vitality drink model has grown its income like gangbusters because it positive aspects market share within the extremely worthwhile vitality drink house and makes buyers a fortune within the course of.

However what’s going to the subsequent 5 years seem like? The corporate has some large plans up its sleeve and simply reported one other sturdy earnings report, sending the inventory near all-time highs. Let’s have a look at the place this monster grower may find yourself in 5 years and whether or not the inventory is a purchase at immediately’s costs.

Slowing income development, increasing margins

On its face, income development regarded a bit weak within the first quarter of 2024. It was simply 37% yr over yr within the interval in comparison with 102% within the fourth quarter of 2023. Gross sales hit $355.7 million — a document — however buyers needs to be rightfully involved about slowing gross sales development as this enterprise matures.

Nonetheless, it seems to be like administration had a good clarification for the massive slowdown: stock buildup amongst its retailers and distributors. In 2023, Celsius’s distributors had been increase stock in anticipation of demand, which led to a pull-forward in income development and people 100%+ numbers.

Now, the alternative is going on, which is inflicting income development to sluggish significantly. From a buyer standpoint, retail gross sales of Celsius had been estimated to have grown 72% yr over yr within the first quarter in the US, which is nearer to the true development charge of the Celsius model. It now has an 11.5% class share in its house market.

A maturing enterprise means increasing revenue margins. Celsius had a document 23.4% working margin within the first quarter, which is a superb signal for shareholders. It’s closing in on competitor Monster Beverage, which had an working margin of 28.5% in the identical interval.

Can the model work internationally?

There may be nonetheless room for Celsius to develop in the US. With how briskly it’s gaining market share, it would not shock me if the corporate doubled or tripled income via market share positive aspects and value hikes. This could assist consolidated income develop for years to return, though you should not anticipate 100% development perpetually.

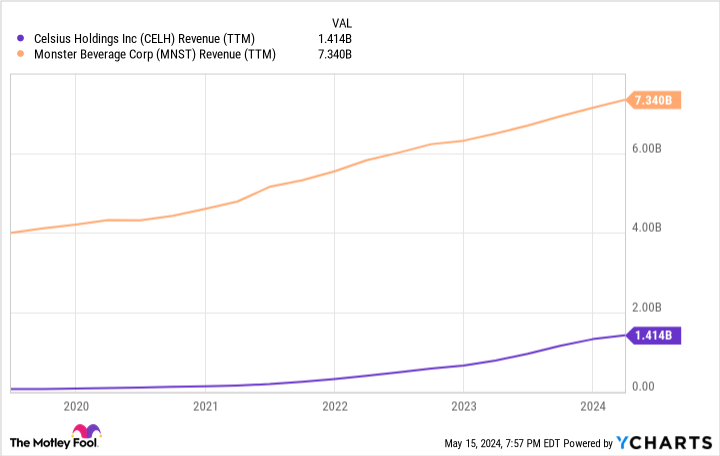

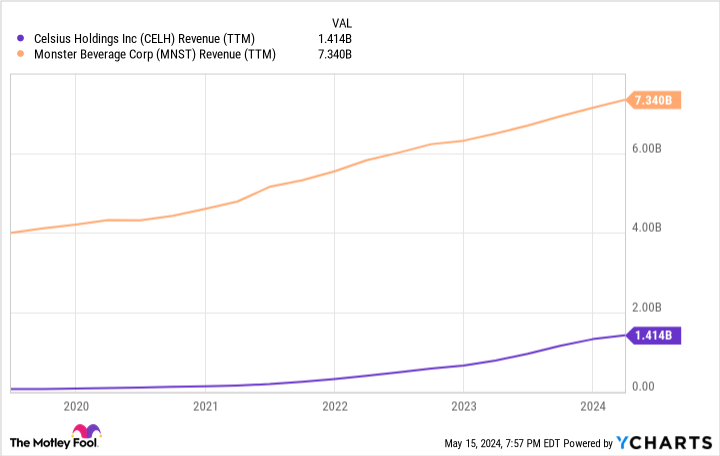

Ultimately, the corporate might want to broaden internationally if it hopes to continue to grow income and match the scale of the business behemoth Monster Beverage. Monster does round $7.3 billion in annual income in comparison with Celsius’s $1.4 billion. The model has introduced expansions into France, Australia, the UK, and New Zealand in latest months.

Thus far, this hasn’t proven up on the earnings assertion. Worldwide gross sales had been simply $16.2 million within the first quarter, or lower than 5% of general gross sales. Buyers cannot anticipate these markets to catch hearth in a single day, however there needs to be some concern that Celsius is unable to duplicate the success it has had in the US in different nations. Worldwide income can be an vital quantity to trace over the subsequent few years as it is going to be the important thing to maintaining these excessive ranges of income development for the model.

The place will Celsius inventory be in 5 years?

Celsius is closing in on $1.5 billion in annual gross sales. Let’s assume it retains rising market share in the US, is ready to implement value will increase to maintain up with inflation, and eventually sees some modest success in new nations over the subsequent 5 years. If this occurs, I believe Celsius may 3x its income to $4.5 billion 5 years from now.

Let’s additionally assume revenue margins broaden to 25% and apply them to a $4.5 billion income base. That’s $1.125 billion in annual earnings. At present, Celsius has a market capitalization of $22 billion, or a price-to-earnings ratio (P/E) of 20 primarily based on this five-year earnings projection. Once more, these are projected earnings 5 years into the long run, not immediately’s earnings. This P/E is barely decrease than the common P/E for the inventory market immediately.

What this tells me is that plenty of sturdy income development is already priced into Celsius inventory, even when you anticipate income to triple over the subsequent 5 years. Because of this, I would not be stunned to see Celsius shares at an analogous degree 5 years from now, making the inventory a dangerous guess for buyers in the meanwhile.

Celsius is a fast-growing firm. However that does not routinely imply the inventory is a purchase.

The place to take a position $1,000 proper now

When our analyst group has a inventory tip, it might probably pay to pay attention. In any case, the publication they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They only revealed what they consider are the 10 finest shares for buyers to purchase proper now… and Celsius made the record — however there are 9 different shares you could be overlooking.

See the ten shares

*Inventory Advisor returns as of Might 13, 2024

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Celsius and Monster Beverage. The Motley Idiot has a disclosure coverage.

The place Will Monster Progress Inventory Celsius Be In 5 Years? was initially revealed by The Motley Idiot