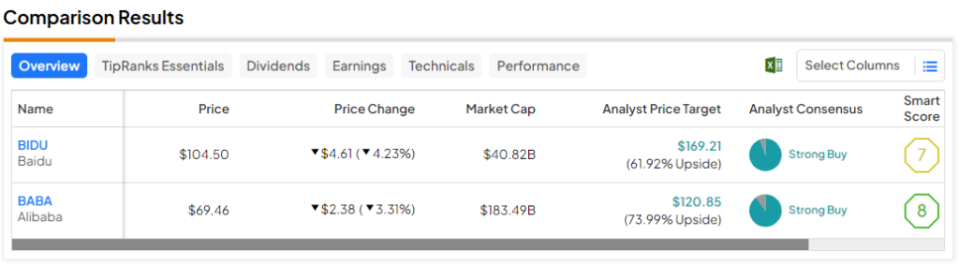

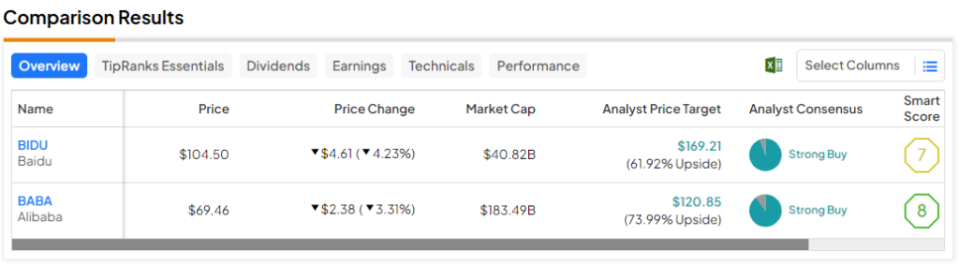

On this piece, I evaluated two Chinese language Massive Tech shares, Baidu (NASDAQ:BIDU), and Alibaba (NYSE:BABA), utilizing TipRanks’ comparability software to see which is best. A more in-depth look suggests impartial views for each, though a transparent winner emerges — within the occasion that the overhangs dissipate.

China-based Baidu is among the largest AI and Web firms on the earth. However, China’s Alibaba makes a speciality of e-commerce, retail, and Web-based applied sciences. Though the 2 firms don’t compete immediately, each are Massive Tech firms primarily based in China, with Baidu typically described as “China’s Google” and Alibaba tagged as “China’s Amazon.”

Shares of Baidu are off 20% during the last yr after a 13% drop during the last three months. The truth is, Baidu inventory plummeted 7% on Friday alone, its largest decline in additional than a yr (extra on that under). In the meantime, Alibaba inventory has plunged 39% during the last yr, together with a 16% decline during the last three months.

Though the 2 firms’ one-year drops are dramatically totally different, their related current declines stem from considerations about China.

In current months, U.S.-listed Chinese language shares, normally, have been falling resulting from worsening relations with China, as evidenced by the Invesco Golden Dragon China ETF (NASDAQ:PGJ). The ETF tracks the Nasdaq Golden Dragon Index of Chinese language shares listed within the U.S. and is down 23% during the last yr and off 8% during the last three months.

Moreover, Goldman Sachs (NYSE:GS) mentioned in early December that China and the broader emerging-Asia market have been among the many most-net-sold areas by hedge funds in November. The truth is, Chinese language equities recorded their fourth consecutive month of web outflows from lengthy/brief fairness managers and the ninth month of web outflows total in 2023.

As such, the numerous China-specific points do play a important position within the scores for each firms, though a better have a look at the company-specific components suggests a transparent winner.

Baidu (NASDAQ:BIDU)

At a price-to-earnings (P/E) ratio of 12.6, Baidu is buying and selling at a steep low cost to its imply P/E of 24.6 since March 2019. Sadly, although, a current report linking its Ernie AI platform to Chinese language army analysis might proceed to weigh on Baidu’s inventory for a while, so a impartial view appears acceptable for now.

Baidu claims that its Ernie AI bot shares related capabilities with OpenAI’s ChatGPT, the primary generative AI bot able to producing virtually human-like responses to queries. Sadly, the South China Morning Put up reported {that a} college affiliated with the arm of the Chinese language army that handles cyberwarfare had examined its AI system utilizing Baidu’s Ernie.

On Monday, the Chinese language search large denied any partnership or affiliation with that college and claimed no data of the analysis in query. Nonetheless, that report raised considerations about the potential for U.S. sanctions in opposition to Chinese language corporations aimed toward curbing such partnerships with the Chinese language army.

Even with none sanctions, the report from the South China Morning Put up might ratchet up tensions between the U.S. and China even additional — at a time when these tensions are already working scorching.

The paper from researchers with the Strategic Assist Pressure of the Individuals’s Liberation Military reportedly outlined theoretical conditions surrounding using AI in conflicts between numerous nations, together with the U.S. and Libya. The researchers additionally reportedly put hypothetical inquiries to Ernie and defined how the AI bot could possibly be utilized to resolve the very best placement of army forces.

Whereas it’s too early to say whether or not Washington will retaliate in opposition to Baidu or to gauge the long-term influence of the report, Baidu’s long-term stock-price returns additionally counsel restricted upside within the close to time period. BIDU inventory has plummeted 56% during the last three years, remaining within the crimson during the last 5 and 10 years, off 36% and 37%, respectively.

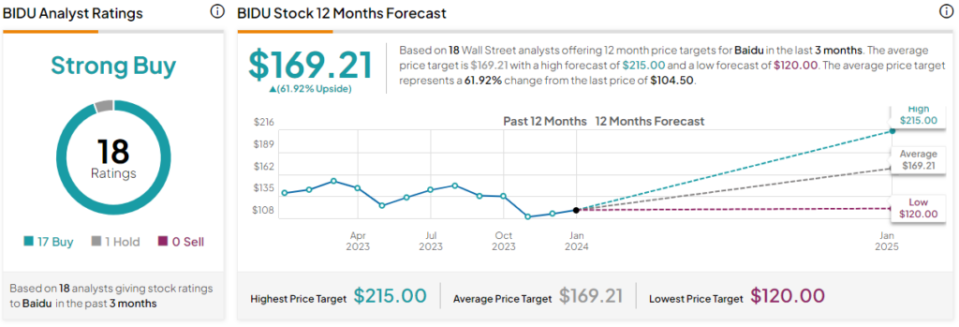

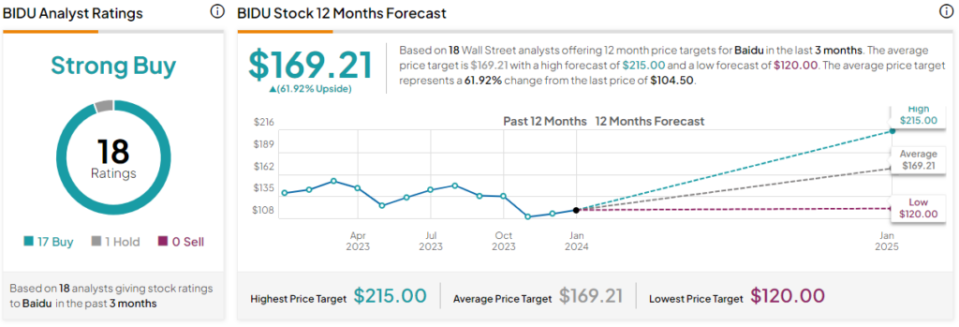

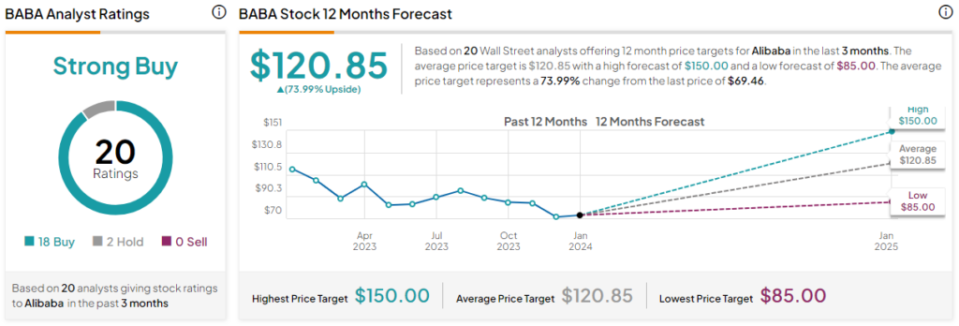

What’s the Value Goal for BIDU Inventory?

Baidu has a Sturdy Purchase consensus ranking primarily based on 17 Buys, one Maintain, and nil Promote scores assigned during the last three months. At $169.21, the common Baidu inventory worth goal implies upside potential of 61.9%.

Alibaba (NYSE:BABA)

At a P/E of 10, Alibaba is buying and selling at a steep low cost to its five-year imply P/E of 35.2. Nonetheless, the China-related points have weighed closely on its inventory over the long run, suggesting a impartial view could also be acceptable — pending some gentle on the finish of the tunnel.

Beforehand, probably the most fascinating a part of the bull case for Alibaba shares was its plan to spin off six of its enterprise models into separate firms, which might unlock vital shareholder worth. Nonetheless, it’s trying like most of these plans received’t occur.

Alibaba inventory plummeted in November after the corporate introduced it was scrapping its plan to spin off its cloud enterprise as a result of expanded U.S. restrictions on exports of pc chips. Beforehand, the corporate additionally halted its plans to listing its Freshippo grocery retain chain, though it’s shifting ahead with the itemizing for its Cainiao sensible logistics enterprise in Hong Kong.

Whereas vital worth could possibly be unlocked for shareholders by way of these spinoffs, the cancellation of two of the six, together with probably the most essential cloud enterprise, is trigger for concern. Moreover, trying over the long run, Alibaba inventory has plunged 71% during the last three years, remaining down 53% during the last 5 years and off 19% since September 2014.

Thus, till China’s economic system begins to indicate actual indicators of restoration and a few of the different China-related points are resolved, or till extra readability across the deliberate spinoffs seems, a wait-and-see strategy appears greatest.

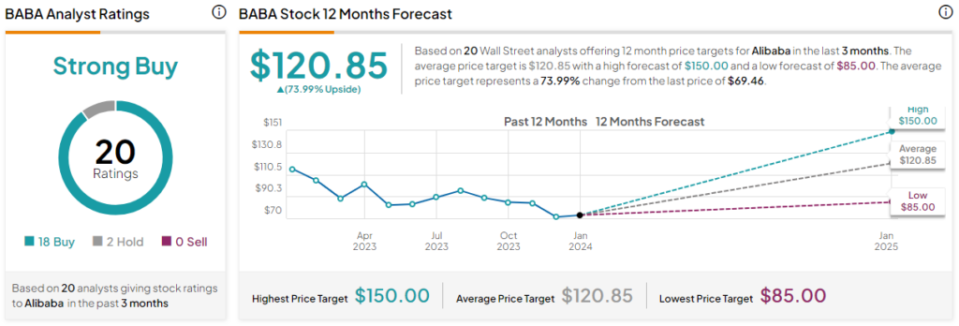

What’s the Value Goal for BABA Inventory?

Alibaba has a Sturdy Purchase consensus ranking primarily based on 18 Buys, two Holds, and nil Promote scores assigned during the last three months. At $120.85, the common Alibaba inventory worth goal implies upside potential of 74%.

Conclusion: Impartial on BIDU and BABA

Though each Baidu and Alibaba obtain impartial views as a result of potential points in China, Alibaba is the clear winner, at the least briefly. Basically, Baidu’s considerations involving the Chinese language army look extra imminent. In the meantime, Alibaba might nonetheless unlock vital worth for shareholders by way of a number of spinoffs — though two of the six are undoubtedly off.

Nonetheless, the steadiness between these two Chinese language shares might immediately shift, making Baidu the favourite if its points are resolved or if Alibaba undoubtedly cancels all of the remaining spinoffs.

Disclosure