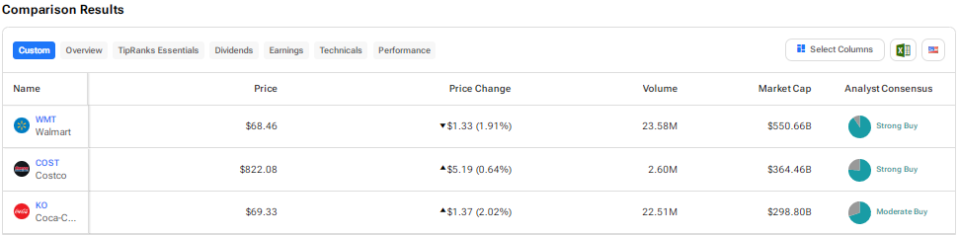

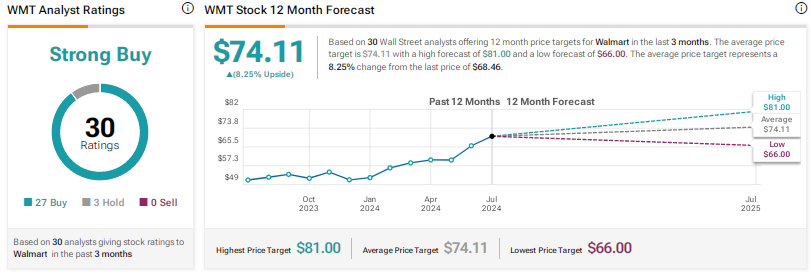

Shopper staples corporations typically are typically resilient throughout difficult macroeconomic occasions. It is because they promote merchandise which are thought-about important for day by day life. Utilizing TipRanks’ Inventory Comparability Software, we positioned Walmart (WMT), Costco (COST), and Coca-Cola (KO) towards one another to seek out the very best shopper staples inventory, based on Wall Avenue analysts.

Walmart (NYSE:WMT)

Shares of big-box retailer Walmart have rallied about 30% up to now this 12 months. WMT impressed traders with its upbeat outcomes for Q1 FY25 (ended April 30, 2024). The 22% progress in Q1 FY25 adjusted earnings per share (EPS) was pushed by sturdy income progress, greater gross margin, and membership revenue.

Walmart’s worth choices proceed to draw bargain-seeking prospects amid a troublesome macro backdrop. The corporate’s grocery enterprise is witnessing sturdy progress, with many purchasers preferring to prepare dinner at dwelling than dine out at eating places on account of excessive inflation.

WMT can also be gaining from the energy in its e-commerce enterprise. In Q1 FY25, WMT’s e-commerce gross sales elevated 21%, fueled by store-fulfilled pickup and supply and the corporate’s rising market. Importantly, the corporate is attempting to reinforce its profitability by specializing in high-margin companies like promoting, membership, market and success options, and information analytics and insights.

Walmart is scheduled to announce its fiscal second-quarter outcomes on August 15. Analysts count on the corporate’s EPS to extend by 6.5% to $0.65 per share and income to develop over 4% to $167.4 billion.

Is Walmart a Good Inventory to Purchase Now?

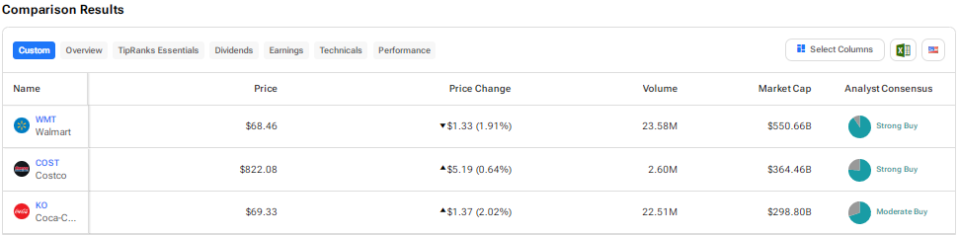

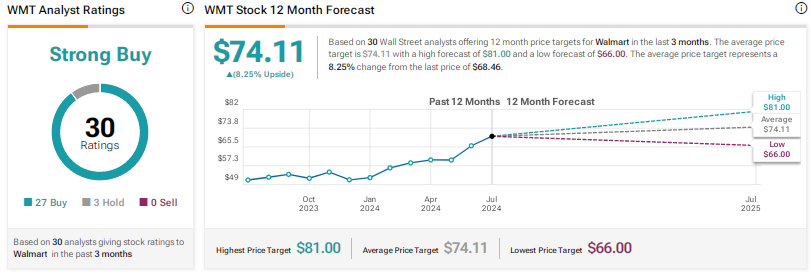

Final week, BMO Capital analyst Kelly Bania raised the worth goal for WMT inventory to $80 from $75 and reaffirmed a Purchase ranking following conferences with the corporate’s administration. The analyst acknowledged that Walmart is well-positioned to extend its EBIT (earnings earlier than curiosity and taxes) at a sooner charge than gross sales, at the same time as the corporate continues to make progress investments.

The analyst thinks that administration’s expectation of the U.S. e-commerce operations turning worthwhile within the subsequent one to 2 years is achievable. His optimism is backed by a 40% discount in supply prices in latest quarters, advantages of provide chain automation, and an increase within the variety of prospects agreeing to pay for sooner supply choices.

Walmart inventory earns a Robust Purchase consensus ranking, backed by 27 Buys and three Holds. The typical WMT inventory worth goal of $74.11 implies 8.3% upside potential. WMT gives a dividend yield of 1.2%.

Costco Wholesale (NASDAQ:COST)

Membership-only warehouse chain Costco Wholesale continues to impress traders with its constant efficiency. Costco’s resilient efficiency is supported by its worth choices and a loyal buyer base. The corporate typically enjoys membership renewal charges of round 90%.

Regardless of macro pressures, Costco introduced better-than-expected June gross sales. The corporate’s web gross sales for the retail month of June (5 weeks ended July 7, 2024) elevated 7.4% to $24.48 billion. Comparable gross sales for June rose 5.3%, with e-commerce gross sales rising 18.4%.

The corporate not too long ago introduced the much-awaited enhance in its membership payment. Buyers cheered the information as Costco’s membership payment accounts for a good portion of its working revenue.

What’s the Goal Worth for Costco?

Following the announcement of the membership payment enhance, TD Cowen analyst Oliver Chen elevated the worth goal for Costco inventory from $850 to $925 and reaffirmed a Purchase ranking.

The analyst believes the corporate’s digital innovation, personalization, and market alternatives help its premium valuation.

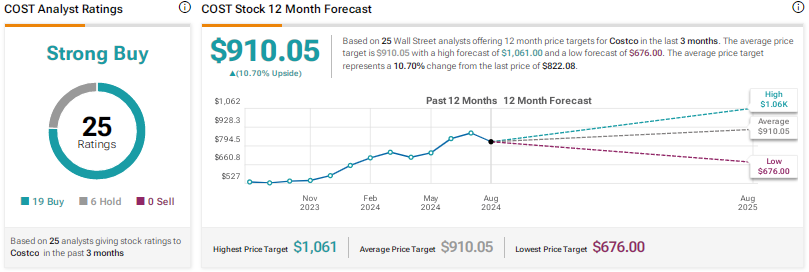

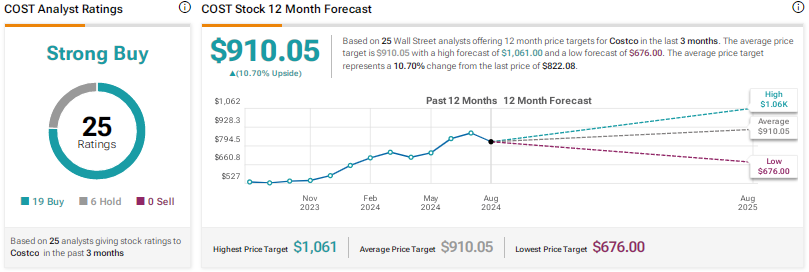

With 19 Buys versus six Holds, Costco inventory is assigned a Robust Purchase consensus ranking. The typical COST inventory worth goal of $910.05 implies about 11% upside potential. Shares have superior 24.5% up to now this 12 months. COST inventory gives a dividend yield of 0.5%.

Coca-Cola (NYSE:KO)

Shares of soda big Coca-Cola have risen about 18% year-to-date. Final month, the corporate introduced better-than-anticipated outcomes for the second quarter, with natural income rising 15%. The corporate’s efficiency mirrored sturdy execution in a difficult enterprise backdrop.

Given the strong Q2 outcomes, KO raised its full-year natural income progress steerage to the vary of 9% to 10% in comparison with the prior outlook of 8% to 9%. The corporate additionally elevated its comparable earnings progress outlook.

Final week, Coca-Cola was within the information on account of an unfavorable improvement associated to its authorized dispute with the U.S. Inside Income Service. The corporate is required to pay $6 billion in again taxes and curiosity to the IRS. Whereas Coca-Cola pays the tax penalty, it can attraction the federal tax court docket’s choice.

TD Cowen analyst Robert Moskow acknowledged that there might be antagonistic implications for the corporate’s tax charge if KO loses the attraction, although “comparatively minor.” The analyst added that his EPS estimates would come down by practically 5% if KO’s tax charge elevated to 24% from 19%.

Is KO a Good Inventory to Purchase?

Most analysts masking KO inventory stay bullish on its prospects. In response to Coca-Cola’s Q2 earnings, RBC Capital analyst Nik Modi reaffirmed a Purchase ranking on KO inventory and raised his worth goal to $68 from $65, citing sturdy top-line progress, quantity momentum, and high-quality earnings within the quarter.

Nevertheless, the analyst identified the corporate’s commentary a few softer third quarter on account of powerful comparisons on a sequential foundation and softness in some developed markets.

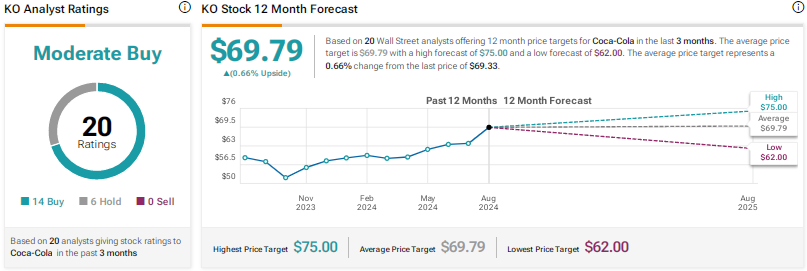

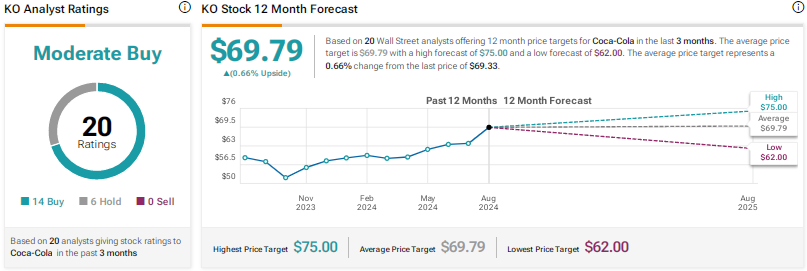

General, Coca-Cola has a Reasonable Purchase consensus ranking based mostly on 14 Buys and 6 Holds. The typical KO inventory worth goal of $69.79 signifies that the inventory is pretty valued at present ranges. KO gives a dividend yield of two.8%.

Conclusion

Wall Avenue is extremely bullish on Costco and Walmart and cautiously optimistic about Coca-Cola. Presently, analysts see comparable upside potential in Costco and Walmart shares. Each these shares have proved the energy of their enterprise fashions and proceed to draw prospects with their worth proposition.

Whereas Wall Avenue has a Robust Purchase ranking on each COST and WMT shares, it’s attention-grabbing to notice that hedge funds have a Very Optimistic Confidence Sign on WMT inventory however a Detrimental sign on Costco. Hedge funds elevated their WMT holdings by 11.5 million shares final quarter. In distinction, hedge funds decreased their COST holdings by 1.1 million shares in the identical interval.

Disclosure