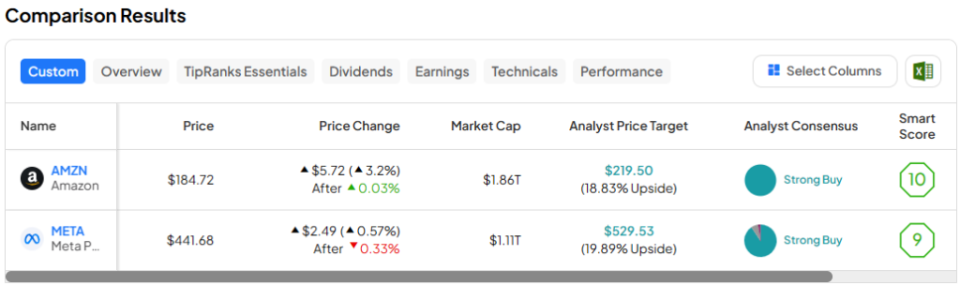

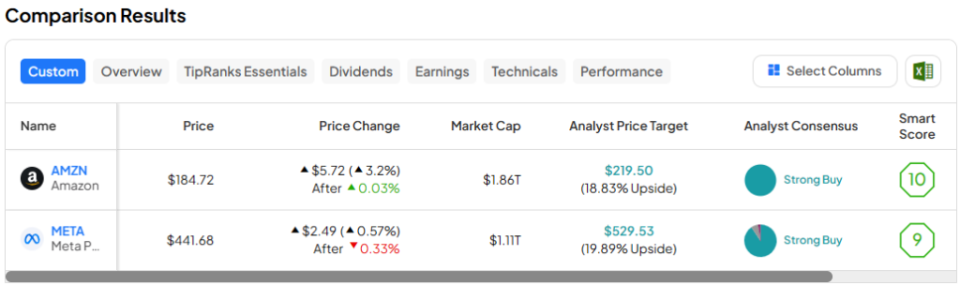

On this piece, I evaluated two of the Magnificent Seven shares, Amazon (NASDAQ:AMZN) and Meta Platforms (NASDAQ:META), utilizing TipRanks’ Comparability Software under to see which is best. A better look suggests a bullish view for Amazon and a impartial view for Meta.

In fact, neither firm wants an introduction, however Amazon is an e-commerce and cloud-computing big, whereas Meta Platforms owns and operates a number of social networks, together with Fb, Instagram, WhatsApp, and others.

Shares of Amazon are up 15% year-to-date and have soared 69% during the last 12 months, whereas Meta Platforms inventory is up 22% year-to-date and 80% during the last 12 months.

Though their year-to-date performances are considerably related, that’s the place the similarities between these two corporations finish. Whereas each are a part of the so-called “Magnificent Seven” shares, they function in completely totally different companies regardless of each having a expertise bent.

Nonetheless, a more in-depth have a look at their newest earnings outcomes and the market’s reactions to these stories reveals one thing very fascinating. Briefly, buyers initially rewarded one for spending extra on synthetic intelligence expertise and punished the opposite for a similar factor.

It appears clear that each Amazon and Meta Platforms may benefit from improved AI expertise, however sadly, this type of manic-depressive habits is commonplace on Wall Road proper now. Let’s see if these completely reverse reactions had been warranted.

Amazon (NASDAQ:AMZN)

At a P/E of fifty.9x, Amazon is buying and selling at a reduction to its five-year imply price-to-earnings (P/E) ratio of 72.2x. Its ahead P/E of about 36.4x can be fairly engaging and suggests analysts are projecting vital will increase in earnings over the following 12 months. Thus, a bullish view appears applicable, particularly contemplating the cloud computing ends in Amazon’s newest earnings report.

For the primary quarter, Amazon reported adjusted earnings of 98 cents per share on $143.3 billion in income versus the consensus estimates of 84 cents per share on $142.5 billion in income. Gross sales in North America rose 12% year-over-year to $86.3 billion, whereas worldwide gross sales grew 10% year-over-year to $31.9 billion. Revenues within the cloud computing phase, Amazon Net Companies (AWS), surged 17% year-over-year to succeed in $25 billion.

Amazon’s administration guided for second-quarter income of $144 billion to $149 billion, which got here up wanting the consensus estimate of $150.1 billion, and working earnings to be between $10 billion and $14 billion. Analysts are additionally projecting adjusted earnings of $1.02 per share for the second quarter.

Though Amazon inventory initially dropped after the April 30 earnings launch, it recovered shortly, hovering from about $179 earlier than the discharge to round $185 now. This motion is especially fascinating in gentle of the corporate’s disappointing steering, because the Road has usually been punishing corporations that come up wanting expectations of their outlooks.

Nonetheless, the preliminary post-earnings drop may have been as a result of press launch with the disappointing steering, with the rebound coming after the earnings name. On that decision, Amazon CEO Andy Jassy attributed the not too long ago achieved $100 billion annual income run fee for AWS to their AI-related enhancements.

Evercore ISI analyst Mark Mahaney additionally instructed shoppers in a word on Tuesday that it was the primary quarter since Q3 2022 by which AWS’s total-dollar income development surpassed that of Microsoft’s (NASDAQ:MSFT) Azure. In reality, AWS is turning into extra worthwhile as nicely, with its working earnings leaping 84% to $9.4 billion and its working margin increasing to 37.6% from 24% within the year-ago quarter.

All of this provides as much as a shiny future for Amazon, which means that it’s meaningfully undervalued at present multiples.

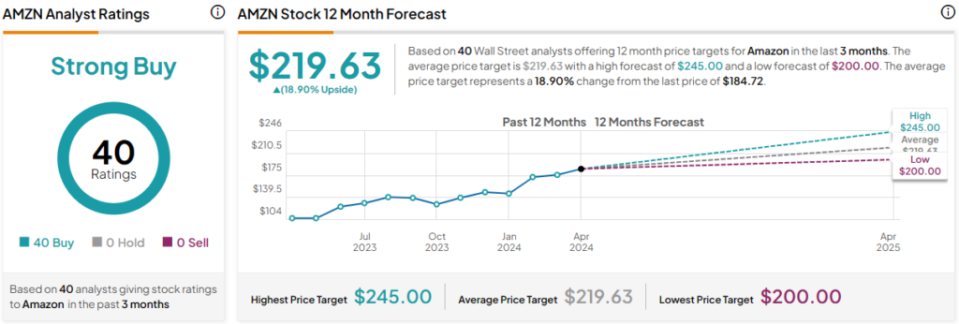

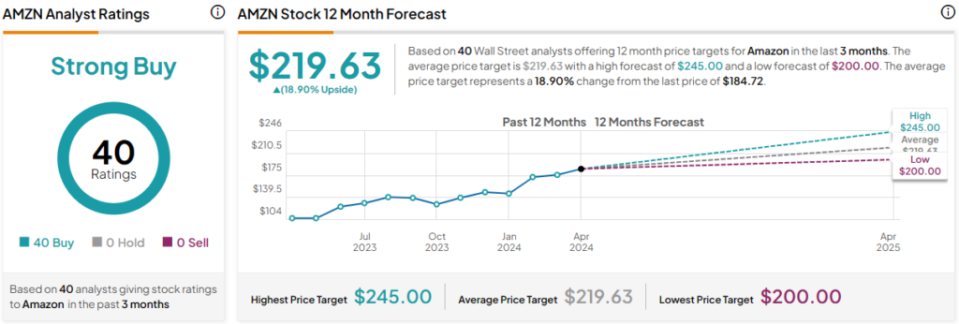

What Is the Worth Goal for AMZN Inventory?

Amazon has a Robust Purchase consensus score based mostly on 42 Buys, zero Holds, and nil Promote scores assigned during the last three months. At $213.74, the typical Amazon inventory value goal implies upside potential of 18.65%.

Meta Platforms (NASDAQ:META)

At its present P/E of about 25.1x, Meta Platforms is buying and selling roughly in step with its five-year imply P/E of about 26.5x. Its ahead P/E of 21.6x suggests analysts are in search of a comparatively small earnings enhance over the following 12 months, however it’s not a big drop between the present and ahead P/E, suggesting a bit extra stability relatively than hovering earnings to come back. Thus, a impartial view appears applicable, particularly contemplating a key piece of the most recent earnings report.

Meta Platforms posted its newest earnings outcomes on April 24, reporting adjusted earnings of $4.71 per share on $36.45 billion in income versus the consensus numbers of $4.32 per share on $36.15 billion in income. Nonetheless, buyers had been displeased with the corporate’s revised outlook, which boosted its anticipated capital expenditures.

Meta now expects to spend between $35 billion and $40 billion on capital expenditures (capex) this 12 months, up from the earlier steering of $30 billion to $37 billion. The corporate stated these elevated capex will allow it to hurry up its infrastructure investments in assist of its AI roadmap.

Meta inventory plunged $50 following that launch, as buyers truly penalized the corporate for its elevated AI spending. Nonetheless, a key distinction from Amazon is that Amazon is already displaying outcomes from its AI investments, whereas Meta is merely planning for future AI enhancements. In fact, Meta has already rolled out some AI enhancements, like its AI chatbot, however it clearly is planning way more with that sizable enhance in capex.

Moreover, Meta’s Actuality Labs division continues to report sizable losses, so buyers could also be involved in regards to the firm’s means to rework new applied sciences into earnings. Within the first quarter, Actuality Labs posted a lack of $3.85 billion, bringing its losses to greater than $45 billion because the finish of 2020.

What Is the Worth Goal for META Inventory?

Meta Platforms has a Robust Purchase consensus score based mostly on 39 Buys, three Holds, and one Promote score assigned during the last three months. At $530.93, the typical Meta Platforms inventory value goal implies upside potential of 20.2%.

Conclusion: Bullish on AMZN, Impartial on META

Whereas it’s onerous to go improper with Amazon or Meta Platforms, Amazon is the clear winner of this pairing as a result of its valuation, profitable implementation of AI to spice up demand, and outcomes from its cloud computing division, AWS.

However, Meta’s AI ambitions are incomplete because it considerably boosts spending on AI. Consequently, these AI efforts appear to be a little bit of a show-me story, no less than till the capital is spent and we see the outcomes of these ambitions. It’s comprehensible that buyers could be involved about Meta’s means to show its new applied sciences into earnings based mostly on the Actuality Labs losses which can be piling up.

Disclosure