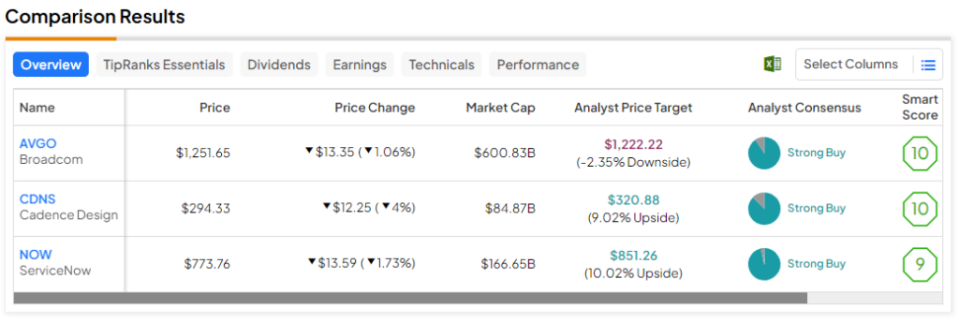

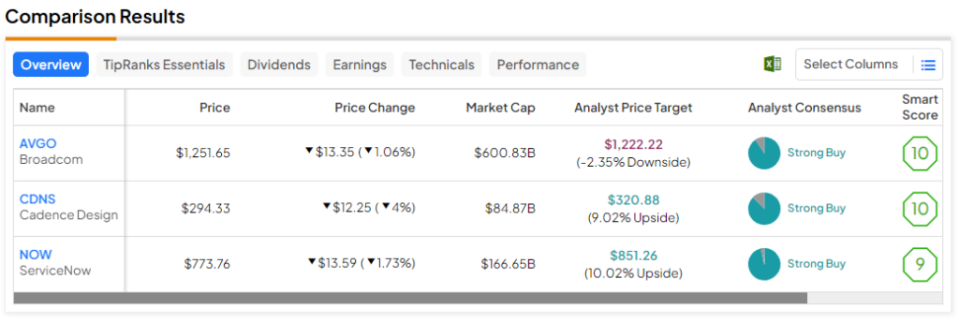

The tech sector has continued to remain scorching up to now this yr. Although valuations could also be a tad uncomfortable for individuals who’ve but to punch their ticket, it needs to be comforting that the Wall Road crowd nonetheless views most of the excessive flyers (like AVGO, CDNS, and NOW) as Robust Buys.

Due to this fact, on this piece, we’ll have a look at TipRanks’ Comparability Software to test in with these three spectacular performers within the tech scene with generative synthetic intelligence (AI) catalysts that might assist them obtain extra features.

Broadcom (NASDAQ:AVGO)

Whereas many of the consideration within the semiconductor scene could also be centered on the 2 prime AI chip corporations, diversified chip play Broadcom has quietly rocketed larger. Whereas the $592 billion chip large might not be the bountiful dividend payer it as soon as was, it nonetheless stands out as one of many higher-growth performs within the semiconductor scene, a minimum of in line with many on Wall Road.

To take it additional, I view AVGO inventory as sporting a extra palatable valuation — 27.4 instances ahead price-to-earnings (P/E) — versus a lot of its chip rivals. As such, I’m staying bullish on the inventory however acknowledge that near-term turbulence may very well be within the playing cards.

It’s exhausting to consider that the inventory used to command a dividend yield north of 3-4%. After greater than doubling (up 112% previously yr), the yield has compressed to 1.64%. Trying again, it’s clear that Broadcom inventory ought to by no means have fallen under $500 per share again in late 2022. Chalk that one as a misstep made by Mr. Market.

Regardless of the new rally (or ought to I say melt-up) within the inventory, JPMorgan (NYSE:JPM) analysts are raging bulls on Broadcom inventory this yr, going so far as to name it the most important AI chip play after Nvidia (NASDAQ:NVDA). That is partly due to Broadcom’s “management place in AI-related merchandise” corresponding to high-end AI ASICs (application-specific built-in circuits) — a lower-power different to GPUs for AI acceleration.

Certainly, it’s not nearly GPUs in terms of AI {hardware}. Arguably, ASICs might expertise a increase of their very own as extra corporations look to tailor their {hardware} for particular AI purposes. After all, ASICs might be pricier to construct from scratch, however relying on the AI software, I view them as deserving a bigger slice of the AI chip pie sooner or later. In the case of AI chips, it’s not all about GPUs. And Broadcom is a good way to play the customization chip pattern because it appears to be like to go after AI accelerators.

What Is the Value Goal of AVGO Inventory?

Broadcom inventory is a Robust Purchase, in line with analysts, with 19 Buys and two Holds assigned previously three months. The common AVGO inventory worth goal of $1,222.22 implies 2.35% draw back potential.

Cadence Design Programs (NASDAQ:CDNS)

Cadence Design Programs is one other semiconductor play that’s been extremely scorching these days, however to not the magnitude of Nvidia. Cadence is a tackle the chip design aspect, a nook of the market that itself may very well be made extra environment friendly by the incorporation of latest AI fashions.

Undoubtedly, chip design is an extremely difficult subject with larger limitations to entry. You want {hardware} engineers who actually know their stuff to make an AI chip that’s as much as requirements. With AI thrown into the equation, the limitations may very well be lowered, maybe drastically.

Certainly, if Cadence can get AI chip design proper (early indicators recommend that the corporate is, given the ability of its Tensilica platform), there’s no telling how a lot larger the inventory might fly because it appears to be like to widen its moat. All secular progress drivers thought-about, I view Cadence as some of the thrilling AI performs proper now and am staying bullish.

The one knock on CDNS inventory lies in its valuation, with shares going for 76.9 instances trailing price-to-earnings, nicely above the semiconductor business common of 45.3 instances however decrease than the appliance software program business common of 86.1 instances. As an software software program play with pores and skin within the chip recreation, I’d argue that the a number of might not be as excessive because it appears, assuming Cadence can outpace its rivals within the chip design scene.

Nonetheless, after releasing its earnings early this week, CDNS inventory took a 4% hit to the chin because the agency stepped ahead with some unimpressive Q1 steering. Certainly, shares appeared priced for perfection forward of the quarter. As shares pull again off their highs in response to the approaching quarterly bout of weak spot, maybe dip patrons will lastly have an opportunity to get into a reputation that has some very highly effective secular progress drivers behind it.

What Is the Value Goal of CDNS Inventory?

Cadence inventory is a Robust Purchase, in line with analysts, with three Buys assigned previously three months. The common CDNS inventory worth goal of $320.88 implies 9% upside potential.

ServiceNow (NASDAQ:NOW)

ServiceNow is a SaaS (software-as-a-service) workflow administration agency that’s additionally been off to the race since bottoming again in late 2022. The corporate isn’t simply melting up as a result of its sturdy product is faring higher once more; traders are excited in regards to the firm’s means to money in on the AI alternative.

Based on ServiceNow’s chief working officer, generative AI represents a $3 trillion alternative for software program corporations. And ServiceNow needs a chunk of the pie because it appears to be like to funnel cash into AI innovation to assist its customers get monetary savings and turn into extra productive. Given this, I can’t assist however be bullish on the inventory regardless of the hefty 91.8 instances trailing P/E.

ServiceNow’s chief govt officer, Invoice McDermott, has additionally been upbeat about generative AI and his agency’s progress prospects. Following the newest quarterly earnings beat, McDermott described AI as a “breakthrough second.” I believe he’s proper. The AI increase appears to have already landed for ServiceNow, and there’s no telling how rather more impression it might have on future quarters.

The inventory’s costly, however it’s pricey for a purpose. Maybe ServiceNow may very well be one of many extra distinguished software program winners of the AI increase because it appears to be like to expertise its personal Nvidia-like melt-up.

What Is the Value Goal of NOW Inventory?

ServiceNow inventory is a Robust Purchase, in line with analysts, with 28 Buys and one Maintain assigned previously three months. The common NOW inventory worth goal of $851.26 implies 10% upside potential.

The Takeaway

The tech tailwind appears to be alive and nicely going into February. Although valuations might turn into stretched, it looks like generative AI may very well be sufficient of an earnings progress driver to assist corporations “catch up” to their now-higher multiples. Of the trio, analysts see essentially the most upside (10%) in shares of NOW for the approaching yr. ServiceNow actually does appear to be one of the best decide of the batch proper now as McDermott and his group proceed to work their magic.

Disclosure