This 12 months seems to be to be the one to spend money on AT&T (NYSE: T) and Verizon Communications (NYSE: VZ). Each of those giants of the telecom trade skilled share-price positive aspects going into 2024. Verizon even hit a 52-week excessive of $43.21 on the finish of January.

The pair additionally sport engaging dividend yields over 6% on the time of this writing. And each skilled a dip in inventory worth lately, so now looks like an excellent time to purchase shares in these telecom titans.

However when you might select just one to spend money on, which wouldn’t it be? The reply is not easy and requires trying into each corporations in additional element. This will help you assess which is the higher funding proper now.

AT&T’s execs and cons

AT&T spent the previous couple of years remodeling its enterprise, divesting leisure property resembling its Warner Media operations. So 2023 was the primary full 12 months that AT&T operated strictly as a telecommunications firm. And it was a strong 12 months for the telecom stalwart.

The corporate’s mobile-wireless enterprise noticed income develop by 2.7% 12 months over 12 months, contributing $84 billion of AT&T’s $122.4 billion in 2023 gross sales. In the meantime, its broadband income skilled wonderful 8% development over 2022, reaching $10.5 billion.

These year-over-year gross sales positive aspects led to AT&T’s free money move (FCF) rising to $16.8 billion in 2023, up from $14.1 billion in 2022. FCF offers perception into an organization’s money out there for actions resembling investing in its enterprise, funding its dividend, and paying down debt.

AT&T’s debt is one space weighing on the corporate’s inventory. Exiting 2023, AT&T’s web debt was an enormous $128.9 billion. Which means a portion of the corporate’s FCF shall be tied up for some time to pay down this debt.

But a constructive signal is AT&T focusing on a web debt-to-adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) ratio within the 2.5 vary a while within the first half of subsequent 12 months. Hitting this aim would deliver its debt burden all the way down to a extra manageable stage.

The case for Verizon

Verizon additionally has amassed a considerable debt load. On the finish of 2023, its web debt was $126.4 billion. However not like AT&T, Verizon’s web debt-to-adjusted EBITDA ratio is already at 2.6, so Verizon is forward of its rival in getting its debt below management.

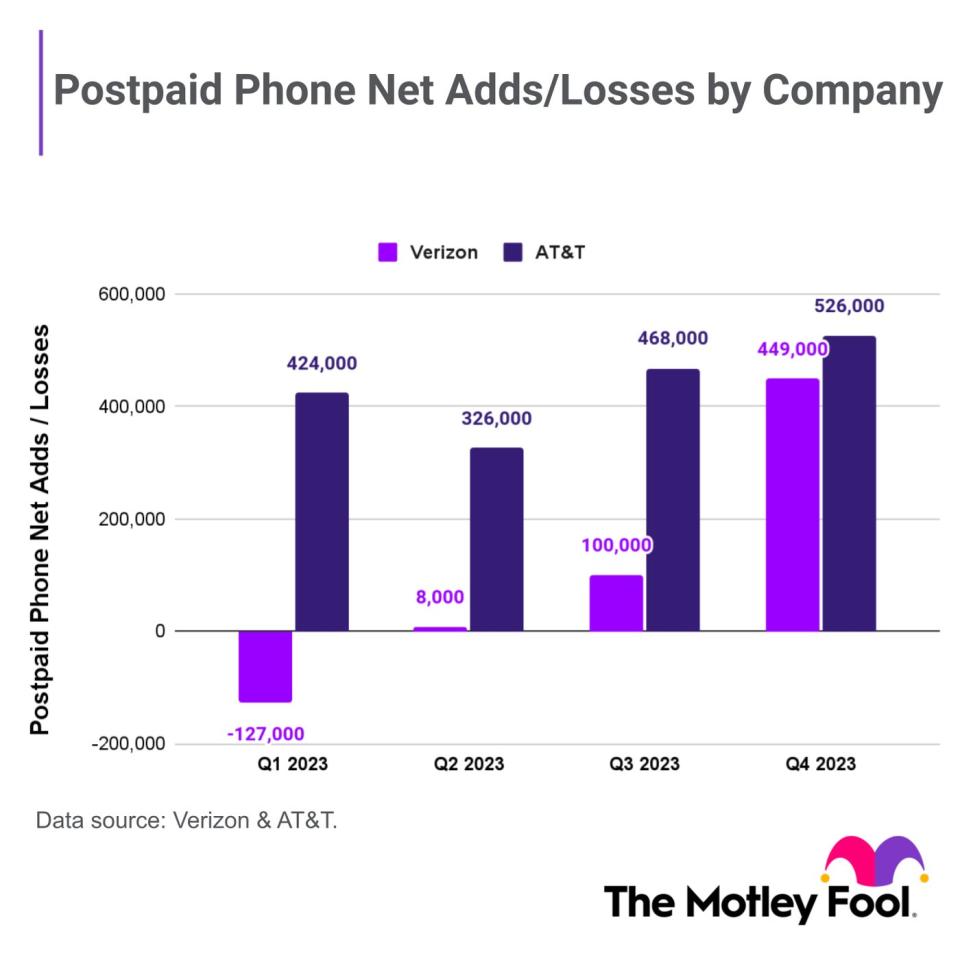

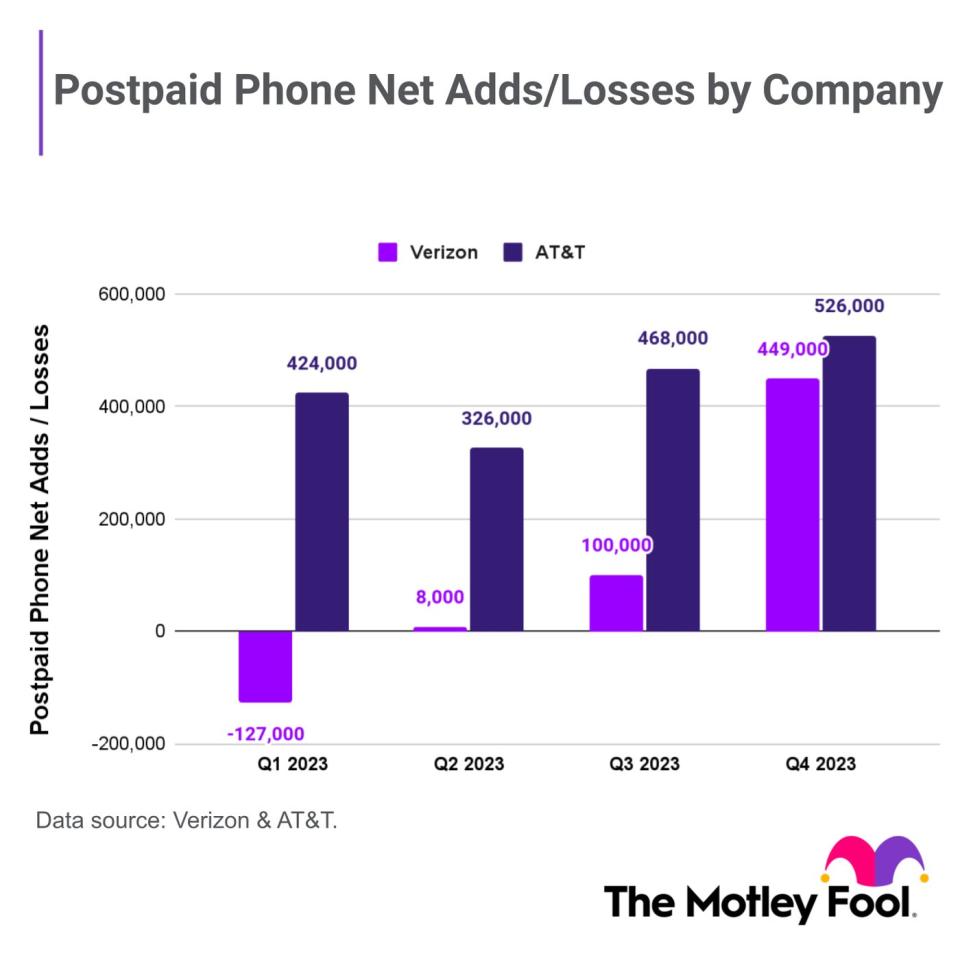

Nevertheless, Verizon has struggled to seize clients within the postpaid phone-subscriber section, shedding out to AT&T all through 2023. Postpaid subscribers are probably the most valued buyer section within the telecom trade.

On the intense aspect, Verizon managed to recoup its postpaid phone-customer losses within the fourth quarter, offering the corporate with some momentum because it entered 2024.

As well as, Verizon’s free money move reached $18.7 billion in 2023, considerably greater than AT&T’s $16.8 billion. Verizon’s superior FCF places it in a stronger place than AT&T to proceed decreasing debt and keep its dividend.

Verizon’s FCF enhance is thanks partially to development in its wireless-service gross sales, which hit $76.7 billion in 2023, a year-over-year enhance of three.2%. This revenue is vital because it comprised the vast majority of the corporate’s $134 billion in 2023 income.

Deciding between AT&T and Verizon

Each AT&T and Verizon possess qualities that make them compelling investments. The previous’s success capturing clients in the important thing postpaid phone-subscriber section is a energy, whereas Verizon’s superior FCF means a extra financially safe dividend.

And on that observe, though each provide related dividend yields, Verizon has raised its dividend for 17 consecutive years. In the meantime, AT&T has not raised its dividend since slicing it in 2022 as a part of its divestiture of leisure property.

Furthermore, Verizon’s 2023 gross sales of $134 billion eclipsed AT&T’s $122.4 billion, enabling greater FCF, which contributed to Verizon’s potential to boost its dividend. Verizon additionally closed out 2023 with a powerful enchancment in postpaid telephone subscribers in the course of the fourth quarter.

Given these components, proper now Verizon seems to be just like the superior long-term funding between these two telecom titans, particularly for passive revenue.

Must you make investments $1,000 in Verizon Communications proper now?

Before you purchase inventory in Verizon Communications, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Verizon Communications wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 12, 2024

Robert Izquierdo has positions in AT&T and Verizon Communications. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a disclosure coverage.

AT&T vs. Verizon: Which Telecom Inventory Is a Higher Purchase for 2024? was initially revealed by The Motley Idiot