There’s a 64% chance that Kamala Harris will win this November’s presidential election, given the inventory market’s robust year-to-date efficiency.

That is reasonably larger than the 58% chance I reported in a column this previous Might. That’s as a result of the inventory market is larger now than it was then, and there’s a important correlation between the inventory market’s election-year efficiency and the incumbent occasion’s possibilities of retaining the White Home.

Most Learn from MarketWatch

Learn extra financial and political information

Many readers have been urging me to replace that column, now that President Biden has withdrawn from the race and Kamala Harris is the presumptive Democratic Occasion nominee. However the change in candidates doesn’t affect the statistical conclusion, which is predicated on the identification of the incumbent occasion moderately than the nominee. The one enter to my easy statistical mannequin is the Dow Jones Industrial Common’s DJIA year-to-date return, which is larger in the present day than three months in the past.

It’s necessary to place this mannequin’s conclusion in its correct context. On the one hand, it in no way is a assure. In 2016, for instance, the inventory market on Election Day was sitting on modest year-to-date good points and the incumbent occasion nonetheless misplaced. In any case, it’s fully attainable the inventory market will fall between now and Election Day and thereby scale back the chances at present calculated by my mannequin. Harris’s chance of successful would drop beneath 50%, for instance, if the DJIA’s year-to-date return on Election Day had been to be unfavourable.

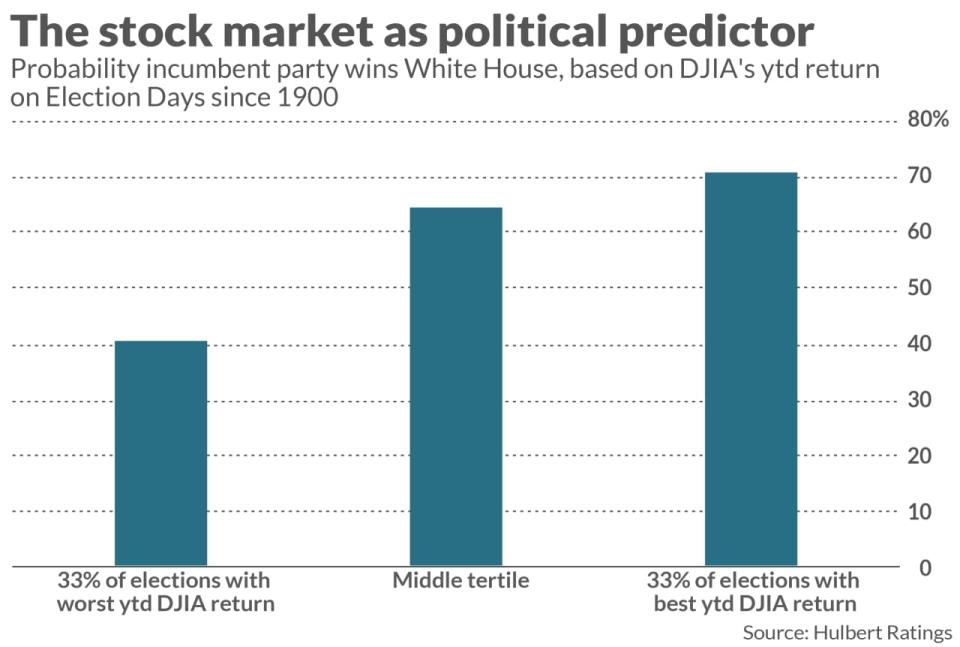

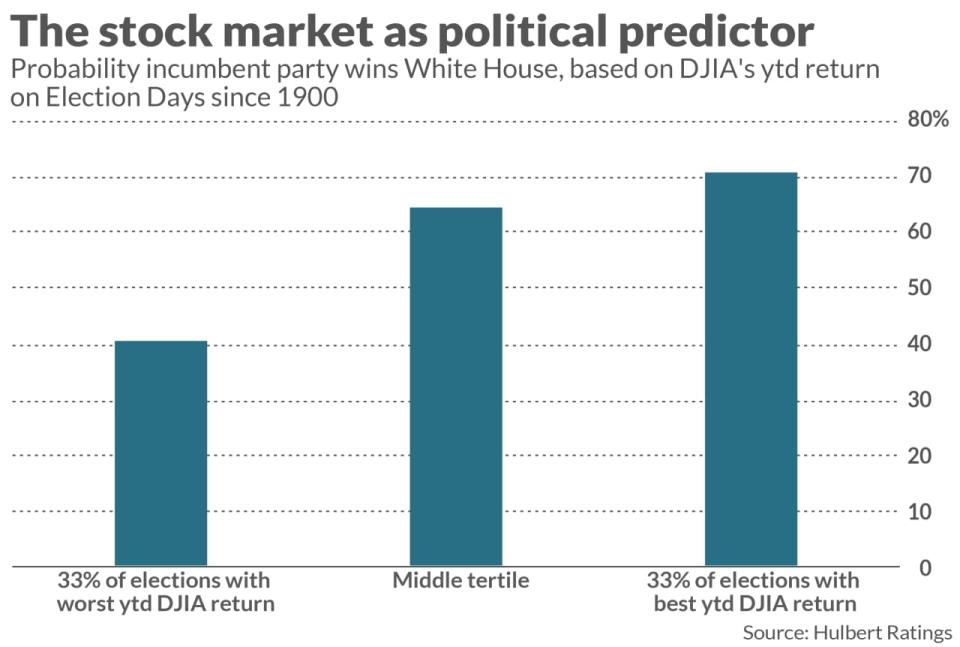

Alternatively, the inventory market has a stronger statistical file than the a number of different indicators that I analyzed, such because the financial system (as measured by GDP), the Convention Board’s consumer-confidence index and the College of Michigan’s consumer-sentiment survey. Take a look at the accompanying chart, which was constructed by dividing all election years since 1900 into thirds, primarily based on the DJIA’s year-to-date return on Election Day. Discover that the incumbent occasion’s possibilities of successful rise with every tertile.

What in regards to the digital futures and betting markets? On condition that they’ve been round for only a handful of presidential election cycles, there’s too little information to know whether or not they have a greater monitor file than the inventory market. However, I observe that these markets at present are inserting related odds on a Harris victory as my inventory market mannequin. The Harris contract at PredictIt.org, for instance, is giving her a 58% chance of successful.