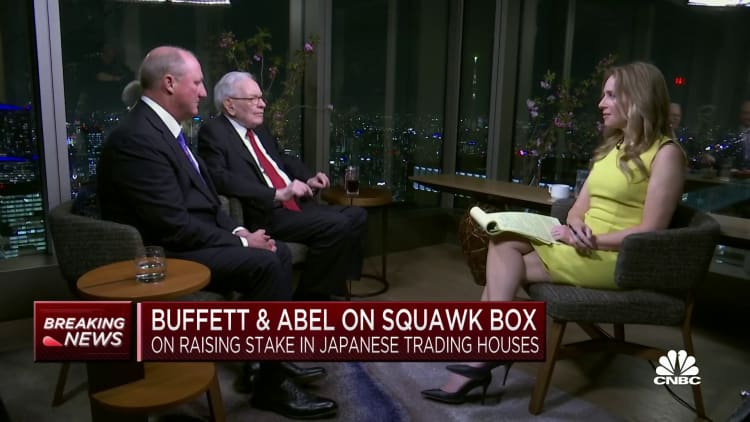

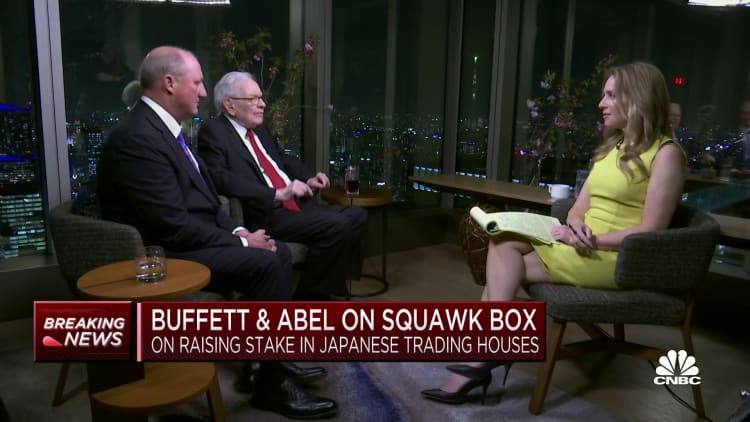

Warren Buffett stated he was “confounded” by the chance to purchase into 5 Japanese buying and selling homes two years in the past.

“I used to be confounded by the truth that we might purchase into these firms,” Buffett informed CNBC’s Becky Fast on “Squawk Field” in an interview from Tokyo on Wednesday. That they had in impact “an earnings yield perhaps 14% or one thing like that, however dividends would develop.”

The Berkshire Hathaway chairman and CEO revealed this week that he had raised his stakes in every of the 5 main Japanese corporations to 7.4%, and added that he could take into account additional investments. Buffett’s journey to Japan is meant to indicate assist for the businesses.

Earnings yield is outlined because the revenue per share divided by the share worth and is a typical measure utilized by worth buyers like Buffett. The upper the quantity, the extra worth buyers are getting per share.

“I simply thought these had been large firms. They had been firms that I typically understood what they did. Considerably just like Berkshire in that they owned numerous completely different pursuits,” Buffett stated. “They usually had been promoting at what I assumed was a ridiculous worth, significantly the value in comparison with the rates of interest prevailing at the moment.”

Buffett, 92, stated Wednesday that Berkshire plans to carry the investments for 10 to twenty years. Berkshire beforehand stated it might elevate its stakes in every of the buying and selling homes as much as 9.9% — although not with out the approval of the corporations’ boards of administrators.

Deal-making?

Berkshire’s vice chairman of non-insurance operations and Buffett’s inheritor obvious, Greg Abel, added in the identical interview that conglomerate can be fascinated with any additional “incremental alternative” with every of the corporations by way of deal-making.

“We’d very a lot consider it rapidly. Warren highlighted the larger the higher, and that he’ll reply the telephone on the primary ring. And we’ll by no means run out of cash. They’ll name us anytime,” stated Abel.

The “Oracle of Omaha” first acquired stakes in these corporations in August 2020 for his ninetieth birthday, in an preliminary buy value roughly $6 billion. The corporations are Mitsubishi Corp., Mitsui & Co., Itochu Corp., Marubeni and Sumitomo.

Often known as “sogo shosha,” Japan’s buying and selling homes are akin to conglomerates and commerce in a variety of merchandise and supplies. With the import of metals, textiles, meals and different items, they helped vaunt the Japan’s economic system to the worldwide stage.

They’ve been criticized by some buyers for his or her advanced operations, in addition to for his or her rising publicity to dangers abroad as they expanded internationally. Nonetheless, for Buffett, these diversified operations may very well be a part of the draw. In addition they boast excessive dividend yields and free money movement.