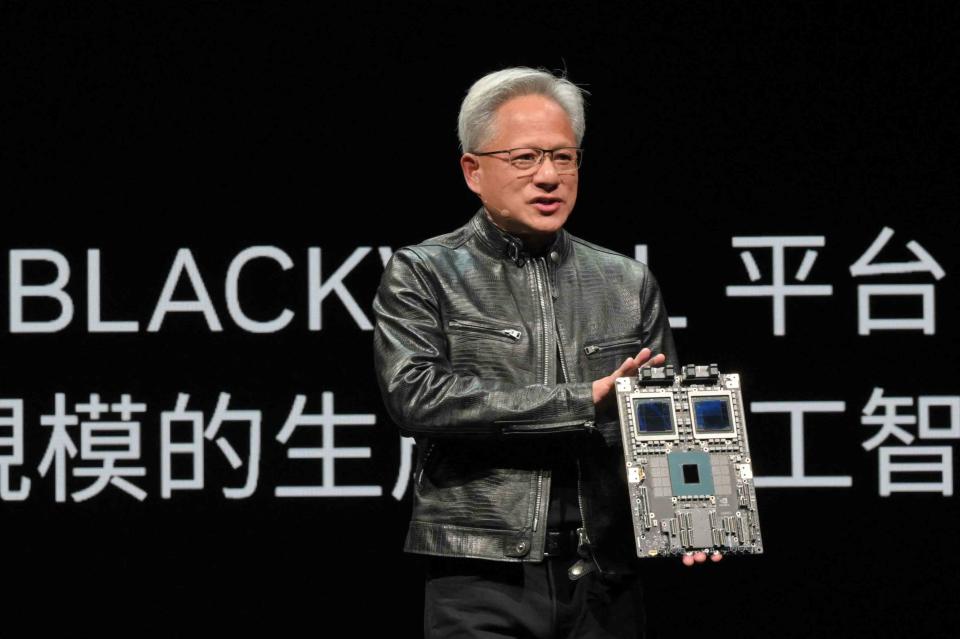

Sam Yeh / AFP / Getty Photographs

Nvidia CEO Jensen Huang delivers his keystone speech forward of Computex 2024 in Taipei on June 2, 2024.

Nvidia (NVDA) inventory rose on Tuesday after Foxconn, the world’s largest contract electronics producer, touted sturdy demand for synthetic intelligence servers.

Executives at Foxconn—formally named Hon Hai Precision Trade—stated Tuesday on the firm’s annual tech day they have been setting up in Mexico the world’s largest facility for assembling AI servers to deal with Nvidia’s GB200 chips, a part of its Blackwell AI structure.

Younger Liu, chair of Foxconn, stated in an interview with Bloomberg Tv that the corporate is aiming to supply 20,000 GB200 NVL72 servers on the manufacturing unit in 2025. HSBC analysts have estimated the value of 1 GB200 NVL72 server is about $3 million.

Demand for Nvidia’s Blackwell system is “awfully large,” stated Benjamin Ting, Foxconn’s senior vice chairman of cloud enterprise options, on the firm’s tech day. Liu advised Bloomberg demand was “loopy,” echoing feedback from Nvidia CEO Jensen Huang final week.

Nvidia Surpassed Microsoft in Market Worth

Nvidia inventory was up 3.5% early Tuesday afternoon, extending positive aspects from yesterday when the corporate overtook Microsoft (MSFT) as America’s second-most priceless firm.

The inventory, which was buying and selling close to $133 on Tuesday, is approaching its document closing excessive of $135.57, which was set on June 18. Nvidia’s all-time intraday excessive, set on June 20, is $140.76.

Nvidia shares have greater than doubled this 12 months after rebounding from a summer time stoop amid experiences {that a} design flaw would delay the rollout of the Blackwell system. These experiences coincided with a sell-off of huge tech shares as earnings disenchanted and Wall Road questioned the knowledge of huge AI spending.

Learn the unique article on Investopedia.