It was one other tough day for Plug Energy (NASDAQ: PLUG) on Wednesday because the market turned south and buyers offered off each higher-risk property and power shares. Shares fell as a lot as 13.5% and have been down 13.2% at 3:30 p.m. ET.

Plug Energy is unraveling

Plug Energy is down 84% prior to now yr, and there isn’t any finish in sight to the drop. Not solely are losses piling up, money can be dwindling and there isn’t any anticipated bailout.

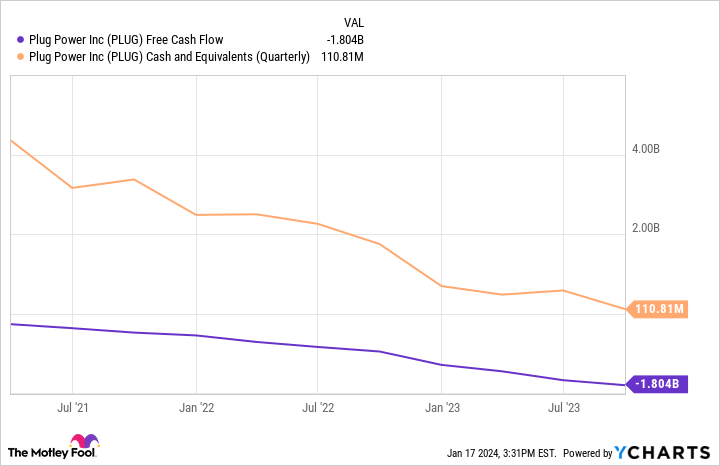

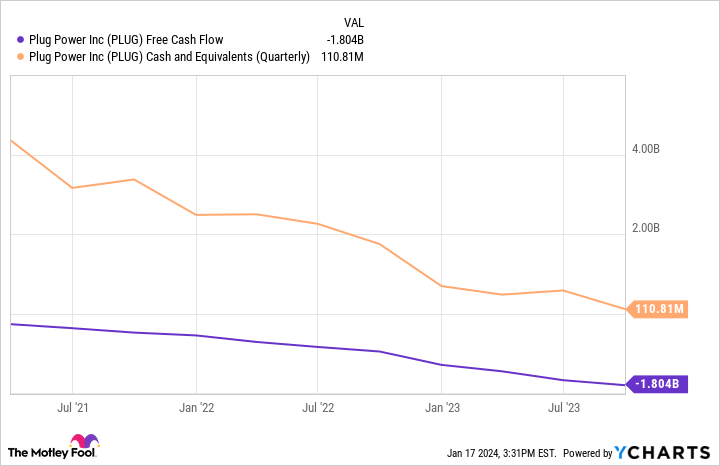

This has turn into a downward spiral for Plug Energy that will not cease. You possibly can see within the chart beneath that money ranges are dropping because the enterprise’ money burn picks up. Administration has beforehand used the corporate’s inventory to fill the money gap by promoting shares, however because the inventory worth drops that choice is probably not out there.

There are billions of {dollars} in bookings and potential orders, however these could take years to materialize, and the monetary problem is far more quick for Plug Energy. The corporate has even warned it is probably not a “going concern,” that means it could not have the power to fund the enterprise by itself.

A freefall that will not cease

Plug Energy has gone by tough instances earlier than, however the problem now could be that it has $200 million in debt and a enterprise that is consuming additional cash than ever. With out the power to lift extra debt or promote inventory, which will get tougher the decrease the inventory worth goes, this inventory could solely head decrease. That looks as if a motive to desert the inventory in the present day, if you have not already.

Must you make investments $1,000 in Plug Energy proper now?

Before you purchase inventory in Plug Energy, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Plug Energy wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 16, 2024

Travis Hoium has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Why Plug Energy Inventory Fell One other 13.5% Right now was initially printed by The Motley Idiot