Snowflake (NYSE: SNOW) inventory made large beneficial properties in Friday’s buying and selling. The info know-how firm’s share worth ended the each day session up 9.4%, in response to knowledge from S&P International Market Intelligence.

Whereas there wasn’t any company-specific information driving Snowflake larger immediately, the corporate’s valuation benefited from robust earnings outcomes printed by main cloud companies suppliers. Specifically, Amazon’s better-than-expected fourth-quarter outcomes helped give Snowflake’s share worth a significant enhance.

Robust cloud demand bodes effectively for Snowflake

Snowflake is a number one supplier of data-warehousing companies and associated analytics and knowledge administration applied sciences. The corporate’s Knowledge Cloud platform helps giant companies and organizations mix info that’s generated throughout Amazon, Microsoft, and Alphabet‘s cloud infrastructure companies. In flip, robust demand indicators for main cloud infrastructure suppliers are inclined to bode effectively for Snowflake’s efficiency.

Amazon’s printed its fourth-quarter report after the market closed yesterday. The outcomes confirmed that the corporate’s gross sales had grown 14% 12 months over 12 months to succeed in $170 billion, coming in considerably forward of the typical analyst estimate for gross sales of $166.2 billion. Gross sales for the corporate’s Amazon Internet Companies (AWS) division rose 13% 12 months over 12 months to hit $24.2 billion.

Amazon’s robust This fall report got here on the heels of better-than-expected outcomes from Microsoft earlier within the week. For the second quarter of its present fiscal 12 months, which closed on the finish of December 2023, Microsoft posted income of $62.02 billion and beat Wall Avenue’s name for gross sales of $61.12 billion within the interval. The software program large’s income was up 18% 12 months over 12 months within the interval, and gross sales for its Azure infrastructure enterprise and different cloud companies rose 30% 12 months over 12 months.

Is Snowflake inventory a purchase?

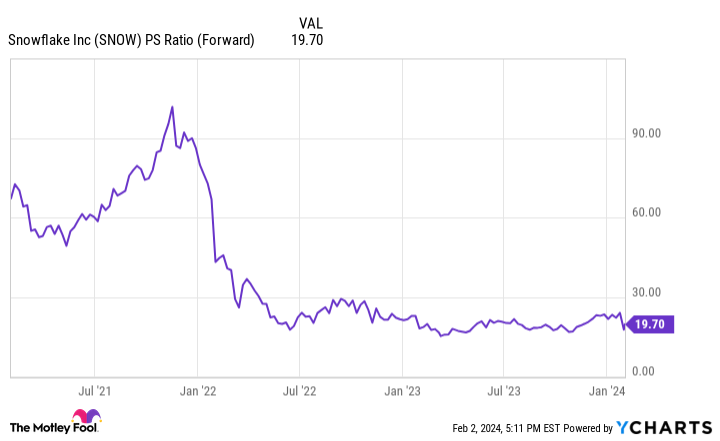

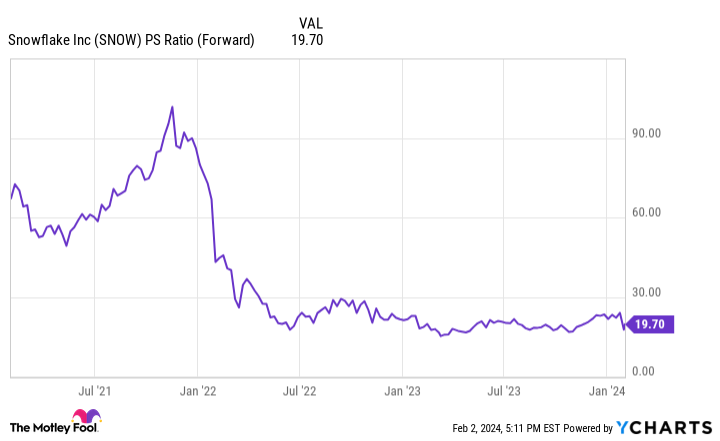

Snowflake inventory has seen robust momentum along with pleasure surrounding synthetic intelligence (AI) and bettering demand outlooks for key cloud companies. On the one hand, the corporate’s share worth nonetheless trades down roughly 46% from the height that it reached in 2021.

Valued at roughly 20 occasions this 12 months’s anticipated gross sales, Snowflake has a extremely growth-dependent valuation. The corporate’s valuation profile implies that its inventory will not be an important match for each investor.

However, Snowflake is rising quickly and is poised to proceed taking part in an necessary position within the evolution of analytics and AI companies. For risk-tolerant buyers, the inventory has the makings of a worthwhile portfolio addition, however it is best to weigh your private tolerance for volatility earlier than stepping into closely on the inventory.

Must you make investments $1,000 in Snowflake proper now?

Before you purchase inventory in Snowflake, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Snowflake wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 29, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, and Snowflake. The Motley Idiot has a disclosure coverage.

Why Snowflake Inventory Soared As we speak was initially printed by The Motley Idiot