The drama of earnings season continued on Thursday as traders digested the most recent monetary reviews and what they imply when it comes to the continued financial restoration.

Buyers have been sitting on the sting of their seats ready to study if the accelerating adoption of synthetic intelligence (AI), which started in earnest final 12 months, will assist drive expertise shares to new heights. Stable outcomes and a blockbuster forecast from an organization deeply built-in within the AI area helped elevate different shares within the sector.

With that as a backdrop, AI server specialist Tremendous Micro Pc (NASDAQ: SMCI) rose 1.6%, AI options supplier C3.ai (NYSE: AI) climbed 3.4%, chipmaker Taiwan Semiconductor Manufacturing (NYSE: TSM) jumped 6.8%, warehouse-automation specialist Symbotic (NASDAQ: SYM) soared 9.2%, and AI audio-solutions supplier SoundHound AI (NASDAQ: SOUN) surged 14.6% by the point the market closed on Thursday.

A test of all the same old suspects — regulatory filings, monetary reviews, and adjustments to analysts’ worth targets — turned up nothing in the best way of company-specific information driving any of those AI shares greater. This means that almost all traders have been captivated by how AI affected the quarterly monetary outcomes of Arm Holdings (NASDAQ: ARM).

A surprisingly sturdy efficiency

The semiconductor specialist reported the outcomes of its fiscal 2024 third quarter (ended Dec 31.), and traders have been watching carefully to see if the corporate would profit from the mad rush to undertake AI — they usually weren’t upset. And whereas Arm’s outcomes have been higher than anticipated, it was the corporate’s blockbuster forecast that caught market watchers unexpectedly.

Arm generated income of $824 million, a rise of 14% 12 months over 12 months. Whereas which may not appear spectacular at first look, it blew previous the corporate’s earlier steering in a variety of $720 million and $800 million. Its earnings additionally received a elevate, with adjusted earnings per share (EPS) of $0.29 rising 32% 12 months over 12 months.

For perspective, analysts’ consensus estimates have been calling for income of $761 million and EPS of $0.25, so Arm sailed previous each benchmarks with ease.

Nonetheless, it was Arm’s forecast for the present quarter that caught traders off guard. Administration mentioned it expects fourth-quarter income in a variety of $850 million to $900 million, effectively forward of Wall Avenue’s expectations of $778 million. The corporate can be forecasting a commensurate enhance in profitability, guiding for adjusted EPS of $0.30 on the midpoint of its steering, crusing previous analysts’ estimates of $0.21.

Additional fueling the fervor have been feedback made by CEO Rene Haas. In an interview with Bloomberg Tv, the chief government mentioned, “AI is just not in any means, form or type a hype cycle,” he mentioned. “We imagine that AI is essentially the most profound alternative in our lifetimes, and we’re solely initially.”

Within the wake of these sturdy outcomes and the CEO’s daring pronouncement, Arm Holdings shares soared practically 48%.

AI will contact each business

It is easy to see why traders received caught up within the frenzy, as Arm’s strong outcomes and dazzling forecast made headlines. Moreover, it has been only a 12 months since generative AI burst on the scene, and plenty of corporations are nonetheless deciding how greatest to implement the expertise. This means that the AI increase may proceed for fairly a while.

So, what does all this must do with our quintet of shares, and the way will they profit from these advances in AI?

-

Tremendous Micro Pc makes high-end servers which might be vitality environment friendly and extremely customizable, serving to meet the rising demand for AI.

-

C3.ai provides turnkey AI options that assist enterprises get AI purposes up and operating rapidly.

-

Taiwan Semiconductor Manufacturing operates a foundry that produces lots of the chips utilized in AI purposes.

-

Symbotic developed an AI-fueled, end-to-end warehouse-automation system that optimizes storage and visitors. As retailers look to profit from AI, Symbotic will possible be excessive on their record.

-

SoundHound AI gives AI-controlled voice and audio options to the automotive and restaurant industries. The corporate’s options will be tailored to restaurant drive-throughs, self-serve kiosks, and telephone orders, amongst others, which is able to assist these companies be a part of the AI revolution.

It is necessary to do not forget that not all AI-centric corporations are created equal. Will probably be necessary as time goes on that these corporations reside as much as the promise of AI by delivering the income and earnings traders count on. Of the 5, solely Taiwan Semiconductor and Tremendous Micro Pc are at the moment worthwhile.

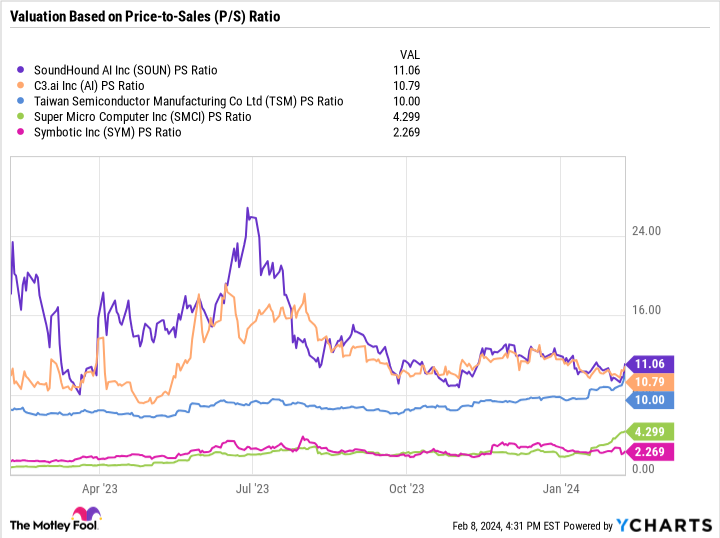

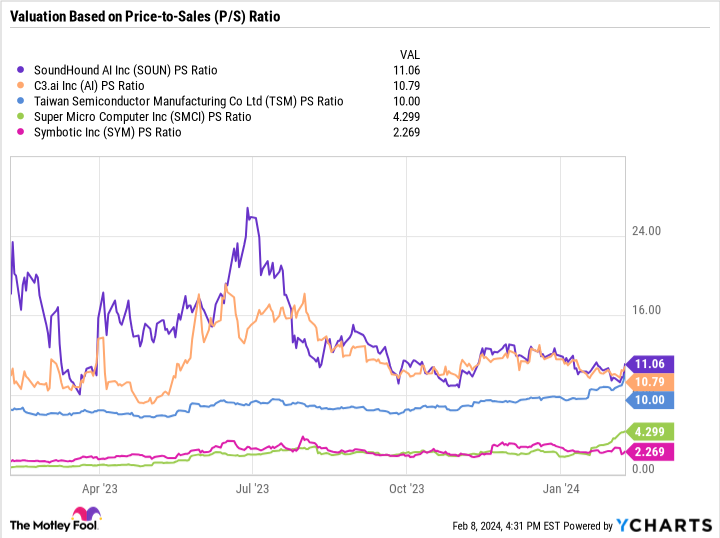

Then, there’s the matter of valuation. SoundHound AI and C3.ai are every promoting for 11 instances gross sales, whereas Taiwan Semiconductor, Tremendous Micro Pc, and Symbotic are promoting for 10 instances, 4 instances, and a pair of instances gross sales, respectively.

For my cash, Taiwan Semiconductor is the least dangerous of the shares introduced right here, and Symbotic is the most effective worth. That mentioned, every of those shares represents an intriguing alternative, however traders ought to dimension their positions primarily based on their danger tolerance and the diploma of volatility they’re ready to face up to.

Must you make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 5, 2024

Danny Vena has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Taiwan Semiconductor Manufacturing. The Motley Idiot recommends C3.ai and Tremendous Micro Pc. The Motley Idiot has a disclosure coverage.

Why Tremendous Micro Pc, C3.ai, Taiwan Semiconductor, and Different Synthetic Intelligence (AI) Shares Rallied on Thursday was initially revealed by The Motley Idiot