Days after reporting robust second-quarter outcomes, Palantir Applied sciences (NYSE: PLTR) gave traders much more excellent news when it introduced an expanded partnership with Microsoft (NASDAQ: MSFT). The intention is to promote analytic and artificial-intelligence (AI) providers to numerous protection and intelligence businesses inside the federal authorities.

Palantir constructed its repute serving to U.S. authorities intelligence businesses monitor and battle terrorism by way of its knowledge gathering and analytics platform, however the authorities has truly change into one of many weak spots for the corporate over the previous couple of years. Let’s take a look at how this deal might change that.

Trying to increase federal authorities gross sales

The U.S. authorities has lengthy been Palantir’s largest buyer, though its development has change into a weak spot for the corporate. Whole authorities income development, together with overseas governments, slowed to 19% in 2022 and solely 14% in 2023.

It has seen a little bit of a rebound this yr, with complete authorities income development of 23% yr over yr to $371 million within the second quarter and U.S. authorities development of 24% to $278 million.

Nevertheless, that also trailed its faster-growing industrial section, which noticed a year-over-year enhance of 33% to $307 million within the quarter. Industrial income within the U.S., particularly, grew even sooner at 55% to $159 million.

This partnership with Microsoft will look to kick begin development in its U.S. authorities section. Palantir’s whole suite of merchandise shall be now be capable to be deployed utilizing Microsoft’s authorities cloud, together with Microsoft Azure Authorities, Azure Authorities Secret, and Azure Prime Secret cloud. The partnership will even use Azure’s OpenAI Service and combine its massive language fashions, together with GPT-4, into Palantir’s Foundry software program and its Synthetic Intelligence Platform (AIP).

One of many large objectives of the partnership shall be to assist velocity up deployments, particularly with AIP. Together with Microsoft, the corporate will run boot camps to let the protection and intelligence group take a look at the know-how.

Palantir has been very profitable in driving new buyer acquisitions with its boot camps within the industrial sector, and it’ll look to take that to the federal sector as properly. These workshops present coaching and display how AIP may be utilized to mission-critical operations and different potential makes use of.

One draw back to Palantir’s authorities enterprise is that it may be contract work for particular tasks. If the corporate can start integrating AIP into extra authorities workloads, it may well assist create a longer-lasting, extra reliably recurring income stream. Offering AI providers to numerous authorities protection and intelligence businesses is a big alternative for the corporate, and the Microsoft partnership ought to make getting approvals simpler.

Is the inventory a purchase?

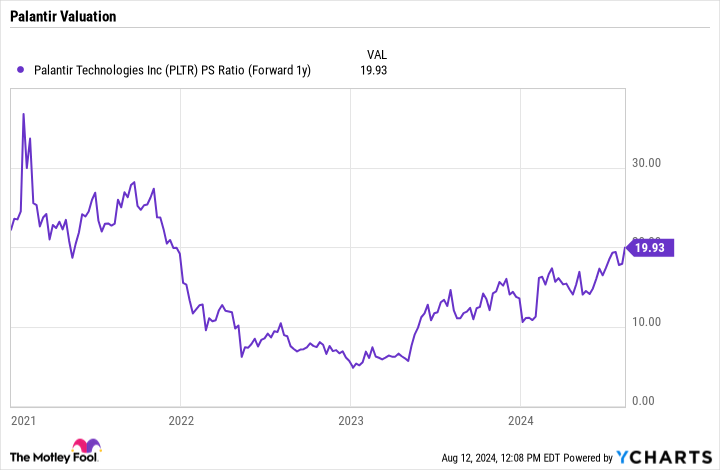

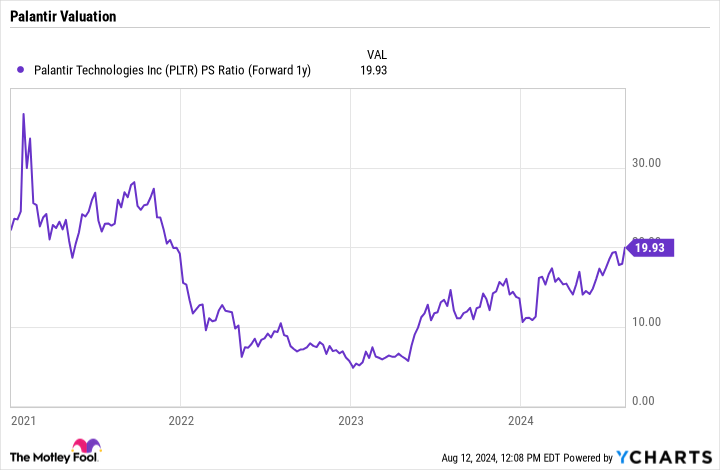

Palantir has proved the power of its know-how, however the one factor that retains many traders cautious is its valuation. The inventory trades at a ahead price-to-sales ratio (P/S) of about 20 occasions based mostly on 2025 analyst estimates.

For a corporation rising income by underneath 30%, that’s fairly an costly a number of. To justify that, it could must speed up it past 30%. Palantir has begun to see a rebound in its U.S. authorities enterprise, and this new partnership might reinvigorate that much more. However based mostly on its present valuation, it seems the market is already pricing that occuring into the inventory.

I believe Palantir has a great long-term alternative, however given its valuation, I’d slightly be a purchaser on a pullback. Even one of the best tech corporations undergo durations when their inventory costs fall, and I would favor to be affected person and never chase the shares at these valuations.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $763,374!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Microsoft and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Will a New Microsoft Partnership Assist Launch Palantir’s Inventory to the Moon? was initially printed by The Motley Idiot