Nvidia (NASDAQ: NVDA) has emerged as the most well liked participant within the synthetic intelligence (AI) house. Its cutting-edge graphics processing items (GPUs) are an important {hardware} aspect of the servers that run superior AI functions.

Within the significantly high-margin class of GPUs tailor-made to run AI and different accelerated computing functions, Nvidia at present instructions roughly 90% of the market. Whereas rivals, together with Superior Micro Units and Intel, are making strikes to ramp up their capabilities within the ultra-high-performance GPU house, many analysts anticipate Nvidia to retain its unimaginable energy within the class.

With unimaginable performances behind it and administration guiding for additional explosive progress, Nvidia inventory has risen by 240% during the last yr and is up 82% to this point in 2024.

These good points have pushed Nvidia’s market cap to roughly $2.27 trillion. It now ranks because the world’s third-most worthwhile firm and the third-most worthwhile member of the “Magnificent Seven.” Apple, at present sitting in second place, has a market cap of $2.65 trillion, whereas prime canine Microsoft is valued at roughly $3.12 trillion.

Might Nvidia quickly be the world’s Most worthy firm?

AI’s most influential participant is reaping the rewards

Beginning late in 2022, unimaginable leaps ahead in synthetic intelligence applied sciences started to emerge at a speedy tempo. That progress ramped up dramatically in 2023, and it has proven no signal of slowing down this yr.

As companies and establishments have made strikes to realize publicity to the AI house, demand has soared for Nvidia’s most superior processors. Its gross sales and earnings have shot via the roof.

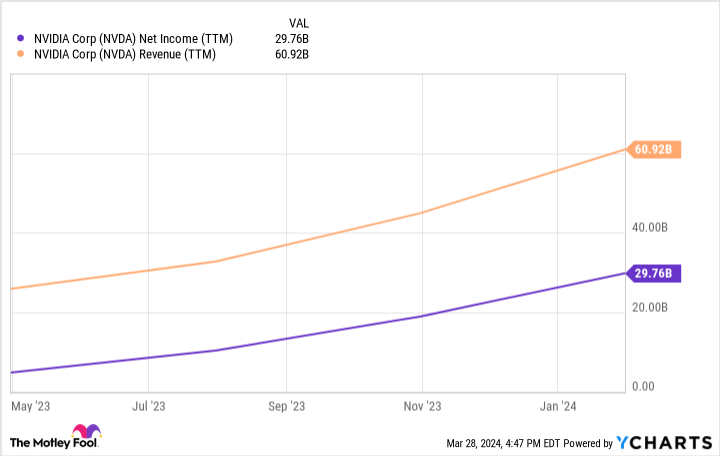

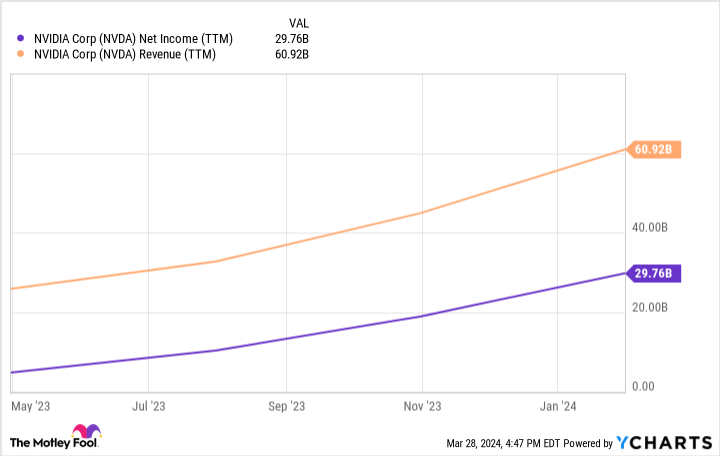

In final yr’s fourth quarter, the corporate’s gross sales grew 265% yr over yr to $22.16 billion. Because of dramatic efficiency acceleration in 2023’s second half, Nvidia’s annual gross sales elevated by 126% to $60.9 billion.

Nvidia posted $29.76 billion in internet revenue final yr — equal to 49% of its whole gross sales. That is an unimaginable internet revenue margin for a hardware-oriented enterprise; these typically have decrease margins in comparison with software-oriented companies because of the larger incremental prices related to producing bodily items.

However the firm’s unimaginable margins replicate simply how extremely in demand its GPUs are proper now. It is affordable to anticipate that Nvidia’s unimaginable progress will average, however the enterprise seems to be poised to develop at a a lot quicker price than Apple and Microsoft for the subsequent few years not less than.

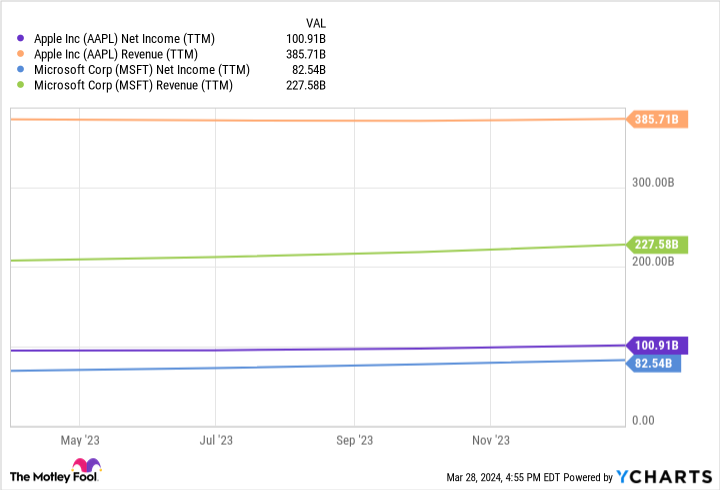

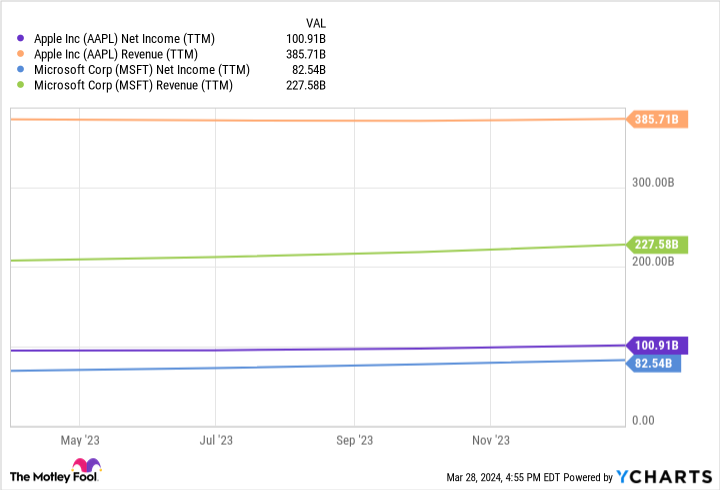

Apple and Microsoft nonetheless generate much more income and internet revenue than Nvidia. Then again, the chip powerhouse seems to be effectively positioned to proceed being the most important winner within the AI revolution, and has been rising at a far quicker price than these bigger tech giants.

For comparability, Microsoft grew its gross sales roughly by 10% over the trailing-12-month interval and elevated its internet revenue by 20%. In the meantime, Apple’s income was flat throughout that stretch, although its internet revenue rose by 7%.

If demand for AI providers continues to rise dramatically, there is a good likelihood that Nvidia will surpass Apple’s market cap and take the title of world’s Most worthy firm from Microsoft throughout the subsequent 5 years. Whereas the GPU chief’s enterprise has traditionally been formed by cyclical tendencies, it nonetheless seems to be within the early phases of benefiting from the unfolding AI revolution.

Proper now, Nvidia is benefiting from the emergence of an unprecedented new know-how — and which means forecasting its efficiency over the subsequent 5 years includes a heavy dose of hypothesis. However given its unimaginable gross sales and earnings momentum and the general market pleasure for synthetic intelligence functions, it would not be stunning to see Nvidia declare the title of world’s Most worthy enterprise.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Apple, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Will Synthetic Intelligence (AI) Enable Nvidia to Crush Apple and Microsoft, and Turn into the Most Helpful “Magnificent Seven” Inventory? was initially revealed by The Motley Idiot