With regards to investing, I’m usually a proponent of shopping for high-quality firms at affordable costs, whatever the short- or intermediate-term noise.

One might argue {that a} living proof is Nvidia (NVDA) – Get Free Report, a inventory that suffered a peak-to-trough decline of 68.8% and bottomed in mid-October.

Nobody is aware of for positive what’s going to come subsequent for the market or the financial system. Inflation is getting again underneath management, however coming at the price of financial output and market liquidity.

Each of these realities have pressured the graphic-chip specialist’s enterprise, in addition to its friends like Intel (INTC) – Get Free Report, Superior Micro Gadgets (AMD) – Get Free Report and others.

Taiwan Semiconductor (TSM) – Get Free Report is reacting favorably on Thursday to its earnings report, however the quarter definitely highlights some challenges throughout the business.

For Nvidia particularly, the inventory has been buying and selling significantly better these days. At one level, the shares had been up greater than 73% from the lows. What’s subsequent for the chip large?

Buying and selling Nvidia Inventory

If one is investing in Nvidia, it’s finest simply to get a great worth, maintain onto the inventory and let the long-term time frames work in your favor. In the event you’re buying and selling, although, entries and exits have to be way more exact.

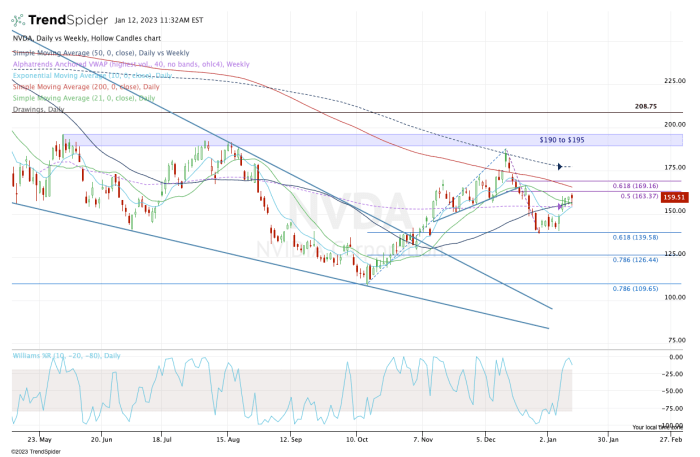

When Nvidia went on a monstrous rally within the fourth quarter, it rallied in seven out of eight weeks earlier than tagging the 50-week shifting common and retreating.

Finally, the shares stuffed the hole close to $142 and located help on the 61.8% retracement. They’re now consolidating in a reasonably tight four-day vary.

From right here, a 15% achieve will ship Nvidia inventory again towards the fourth-quarter highs. Conversely, a 15% decline will drop the shares again all the way down to the current lows and prior help close to $140.

As we’re in the midst of that vary, it’s robust to know which means this one will fall. On the upside, keep watch over the $163.50 to $165 space. There we discover the 50% retracement and the 200-day shifting common.

If Nvidia can clear these ranges, then $169 is in play, opening the door again to the 50-week shifting common and the December excessive close to $188.

On the draw back, it’s even clearer. The $154.50 to $155 space has been key help and in the present day’s low is true in that vary at $154.92.

So long as Nvidia inventory holds this zone, it seems superb on the lengthy facet.

Nevertheless, a break of this space means the inventory won’t solely lose in the present day’s low and up to date help, but in addition the 10-day, 21-day and 50-day shifting averages, in addition to the every day VWAP measure.

That places the gap-fill in play close to $150, then a possible decline into the low-$140s.

When buying and selling, do your finest to maintain it easy and go degree to degree. It could assist to notice worth motion like this: “If $154.50 fails, that’s an indication that consumers lack energy and places $150 in play. Beneath $150 and bears achieve momentum, placing $142 in play.”

The alternative can utilized on the upside.