Inflation has been a large subject for almost each main nation for the previous yr or so.

Shoppers and firms alike have felt the ache, with the earlier 4 quarters of earnings proving to be comparatively lackluster. Whereas inflation is slowly declining, it has brought about the debt of the U.S. and different nations to soar.

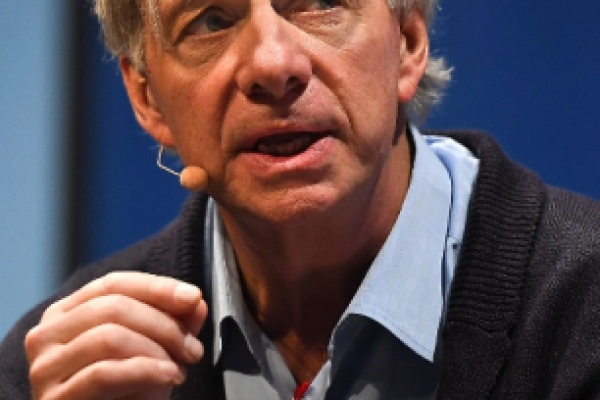

Between robust inflation and the huge debt burden, the founding father of the world’s largest hedge fund is sounding the alarm. Bridgewater Associates Founder Ray Dalio has grown his investing empire into one of many largest hedge funds on this planet.

In a current interview with CNBC, Dalio mentioned, “Cash as we all know it’s in jeopardy [because] we’re printing an excessive amount of, and it is not simply the US.”

Dalio dominated out Bitcoin as an answer as a result of he says it is proved to be too risky, doesn’t relate to something, and plenty of industries are extra fascinating than crypto.

To remain up to date with high startup investments, join Benzinga’s Startup Investing & Fairness Crowdfunding E-newsletter

Whereas Bitcoin isn’t the reply, a digital foreign money might be. “I feel that what would … be greatest is an inflation-linked coin,” mentioned Dalio, noting that the closest factor available on the market to his imaginative and prescient is an inflation-linked index bond within the type of a foreign money.

That is in stark distinction to the current narrative round digital currencies and crypto. The sentiment round crypto and different digital currencies is probably going at an all-time low due to the current collapses of FTX, Celsius Community LLC, BlockFi and several other others. However Bitcoin is up as a lot as 50% since its November lows that means there is perhaps some alternative there for traders as sentiment rebounds — even when it doesn’t operate as foreign money.

Some startups may benefit from this rebound in sentiment, together with Gameflip. Gameflip is a startup with over $140 million in quantity for its non-fungible token (NFT) and gaming belongings market that would profit from a rebound in crypto-based belongings even because it continues to be rooted within the broader recession-resistant gaming market. Gameflip is elevating on StartEngine, which suggests anybody can make investments for a restricted time.

The broader inventory market additionally supplies choices. Bridgewater’s two largest holdings are Proctor & Gamble Co. and Johnson & Johnson, which account for about 8% of its complete portfolio. Dalio famous that he sees biotech and different industries as “extra fascinating than Bitcoin.”

See extra on startup investing from Benzinga.

Authentic story discovered right here.

Do not miss real-time alerts in your shares – be part of Benzinga Professional without cost! Attempt the device that may assist you to make investments smarter, quicker, and higher.

This text World’s Largest Hedge Fund Founder Ray Dalio Says Money Is ‘In Jeopardy’ however Sees an Sudden Answer initially appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.