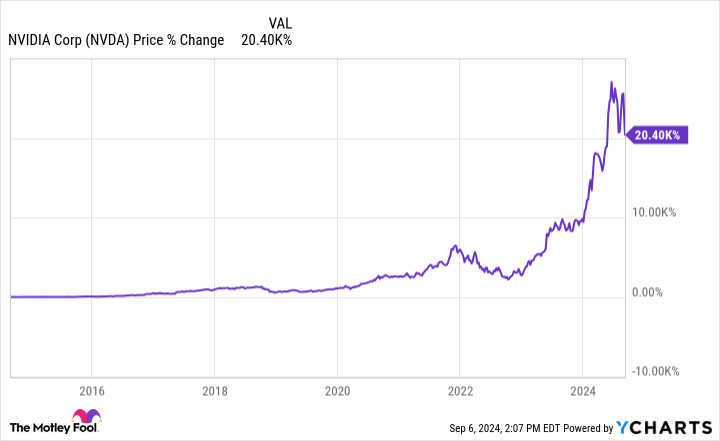

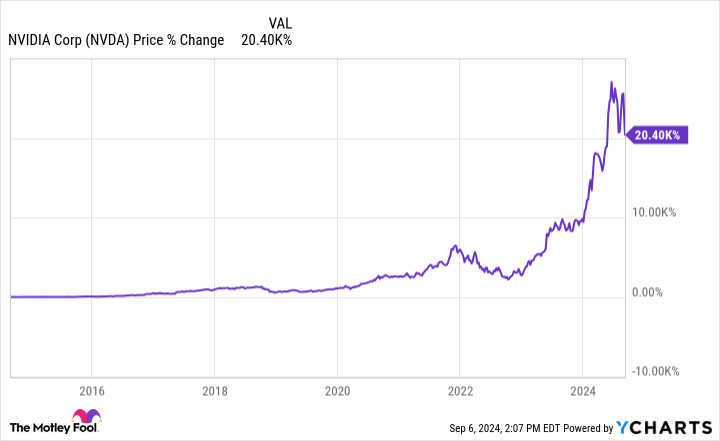

Maybe no inventory has risen extra so quick than Nvidia (NASDAQ: NVDA). At one level, it was up by about 1,000% in lower than two years, briefly taking its market cap north of $3.2 trillion earlier than it pulled again.

Nevertheless, the run-up within the firm’s inventory was so excessive that even its stellar earnings report for the second quarter of fiscal 2025 (ended July 31) failed to forestall a major sell-off in its inventory. Between the corporate’s possible overvaluation and a momentum shift, buyers ought to in all probability keep away from the semiconductor inventory for the rest of 2024.

The state of Nvidia

In gentle of the latest pullback, buyers must train some perspective. The scorching demand for AI chips and Nvidia’s appreciable lead on this area of interest of the chip trade arguably make it the premier semiconductor inventory.

The expansion within the AI chip market has been so explosive that Allied Market Analysis forecasts a compound annual progress fee (CAGR) of 38% by 2032. That is far above the 6% CAGR that Allied forecast for the general chip trade by 2031.

Moreover, Nvidia seems poised to start delivery its next-generation AI chip Blackwell within the fourth quarter. This could assist it keep its market lead as its rivals battle to catch as much as the chip large.

Contemplating Nvidia’s technical lead, present shareholders ought to in all probability keep within the inventory as a result of it’s going to possible stay a long-term winner. In time, it might even change the struggling Intel as a Dow 30 inventory.

So, what occurred?

Regardless of Nvidia’s enormous potential, the short-term outlook for its inventory appears to be like more and more bleak. Amid a number of quarters of triple-digit income progress, the corporate finally fell wanting more and more elevated expectations. Consequently, the inventory is down by about 25% from its 52-week excessive.

Admittedly, its positive aspects might have appeared justified from the attitude of its price-to-earnings ratio (P/E). At simply 48 occasions earnings, Nvidia might look undervalued when contemplating the corporate’s triple-digit proportion income and earnings progress.

Nonetheless, the opposite metrics might have left buyers questioning Nvidia’s present value. Its price-to-sales (P/S) ratio had exceeded 40 as just lately as July, and the present gross sales a number of of about 27 makes it costly by nearly any measure.

Additionally, its valuation appears to be like extra stratospheric when bearing in mind its price-to-book worth ratio of 43. With AMD and Qualcomm promoting at a respective 4 occasions and seven occasions guide worth, Nvidia might have hassle justifying its enormous premium.

Furthermore, buyers are inclined to bitter on shares with slowing progress, even when the expansion fee is strong. This will not be truthful, however the truth is that triple-digit progress numbers are unsustainable over the long run. Additionally, clients are more likely to flip to the corporate’s rivals’ slower however out there AI chips as Nvidia struggles to satisfy demand.

Moreover, buyers must hold the historical past of Nvidia inventory in thoughts. Regardless of the positive aspects of greater than 20,000% in the course of the previous 10 years, the inventory has additionally fallen by greater than 50% twice throughout that interval.

Such sell-offs are inclined to happen as a result of the chip trade and its shares transfer in cycles. Whereas the upward strikes on this inventory have handsomely rewarded shareholders, they’ve additionally needed to endure brutal sell-offs. With Nvidia possible in a bear section now, buyers might wish to wait till 2025 earlier than they contemplate including shares.

Nvidia inventory’s future

Given Nvidia’s momentum and its excessive valuations, buyers ought to in all probability chorus from including the corporate’s shares within the final months of 2024. Admittedly, the bull market in AI chips is probably going not over, and present shareholders ought to profit in the long run by staying within the inventory.

Nonetheless, each investor expectations and the inventory value seem to have grow to be too indifferent from the basics. Thus, buyers ought to in all probability wait just a few months earlier than including to positions in Nvidia inventory.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $652,404!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

Will Healy has positions in Superior Micro Gadgets, Intel, and Qualcomm. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Nvidia, and Qualcomm. The Motley Idiot recommends Intel and recommends the next choices: quick November 2024 $24 calls on Intel. The Motley Idiot has a disclosure coverage.

Prediction: Nvidia Inventory Might Tumble within the The rest of 2024 was initially revealed by The Motley Idiot