March 17 (Reuters) – European Central Financial institution supervisors see no contagion for euro zone banks from latest sector turmoil, a supply mentioned on Friday, after U.S. lenders threw First Republic Financial institution (FRC.N) a $30 billion lifeline and tapped report quantities from the Federal Reserve.

Massive U.S. banks on Thursday swooped in to rescue the San Francisco-based lender, which was caught up in market volatility triggered by the collapse of two different mid-size U.S. banks.

The rescue package deal got here shortly after embattled Credit score Suisse (CSGN.S) tapped an emergency central financial institution mortgage of as much as $54 billion to shore up its liquidity.

Shares in Switzerland’s second-largest financial institution fell once more on Friday regardless of the transfer, with First Republic’s shares indicated 12% decrease in U.S. pre-market buying and selling.

The ECB held an advert hoc supervisory board assembly, its second this week, to debate the stresses and volatility within the banking sector in an uncommon transfer forward of a scheduled one subsequent week.

However the supervisors noticed no contagion to euro zone banks from the market turmoil, a supply accustomed to the assembly’s content material instructed Reuters, including they had been instructed deposits had been steady throughout the sector and Credit score Suisse publicity was immaterial.

An ECB spokesperson declined to remark.

Euro zone banks are nonetheless sitting on some 4 trillion euros ($4.25 trillion) value of extra liquidity, which they’re even eager handy again to the ECB now that borrowing from it has change into costlier, as central financial institution knowledge confirmed on Friday.

A German authorities spokesperson mentioned the present state of affairs with European banks isn’t similar to the 2008 monetary disaster, including throughout an everyday information briefing that there isn’t a trigger for concern concerning the nation’s banking sector.

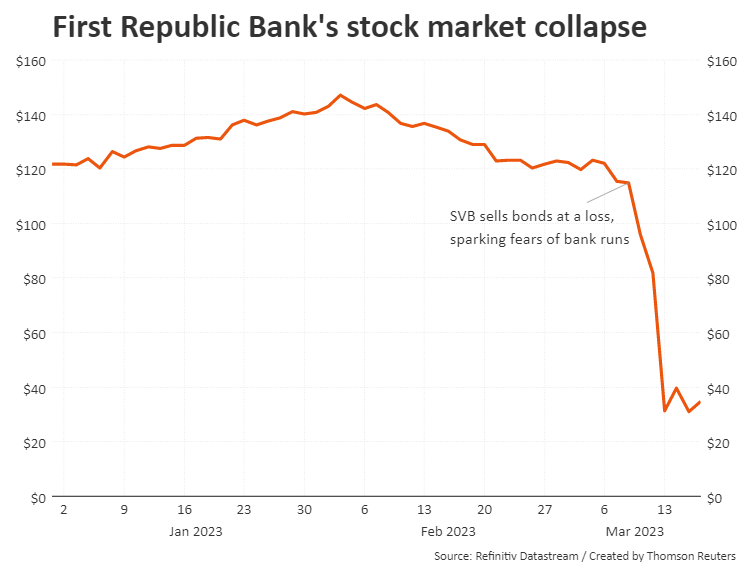

Banking shares globally have been battered since Silicon Valley Financial institution collapsed final week as a consequence of bond-related losses that piled up when rates of interest surged final yr, elevating questions on what else could be lurking within the wider monetary system.

Whereas the 2 offers and motion by policymakers have helped restore some calm, analysts and buyers are nonetheless involved concerning the potential for a full-blown banking disaster.

The dimensions of stress was underscored by knowledge on Thursday displaying banks within the U.S. sought report quantities of emergency liquidity from the Fed in latest days, driving up the dimensions of the central financial institution’s stability sheet after months of contraction.

The First Republic deal was put collectively by energy brokers together with U.S. Treasury Secretary Janet Yellen, Fed Chairman Jerome Powell and JP Morgan CEO Jamie Dimon, a supply accustomed to the state of affairs mentioned.

“They are going to preserve the cash in First Republic to maintain it alive for self curiosity … to cease the run on banks. Then they may take it away steadily and the financial institution will play out a sluggish dying,” Mathan Somasundaram, founder at analysis agency Deep Knowledge Analytics in Sydney, mentioned on Friday.

Among the greatest U.S. banking names together with JP Morgan Chase & Co (JPM.N), Citigroup Inc (C.N), Financial institution of America Corp (BAC.N), Wells Fargo & Co (WFC.N), Goldman Sachs (GS.N) and Morgan Stanley (MS.N) had been concerned within the rescue, in accordance with a press release from the banks.

Whereas the assist has prevented an imminent collapse, buyers had been startled by First Republic’s late disclosures on its money place and simply how a lot emergency liquidity it wanted.

“Individuals are involved that the contagion threat is actual, and that rattles confidence,” mentioned Karen Jorritsma, head of Australian equities, RBC Capital Markets.

“I do not assume we’re within the crux of a world monetary disaster. Steadiness sheets are significantly better than they had been in 2008, banks are higher regulated,” she added.

Credit score Suisse turned the primary main world financial institution to take up an emergency lifeline for the reason that 2008 monetary disaster amid doubts over whether or not central banks will have the ability to maintain aggressive charge hikes to rein in inflation.

LESSONS FROM 2008

For now, authorities are assured the banking system is resilient and have tried to stress that the present turmoil is completely different to the worldwide monetary disaster 15 years in the past as banks are higher capitalised and funds extra simply out there.

The ECB pressed ahead with its 50 foundation level charge hike, arguing that euro zone banks had been in good condition and that if something, larger charges ought to bolster their margins.

Focus now swings to the Fed’s coverage resolution subsequent week and whether or not it should keep on with its aggressive rate of interest hikes because it seeks to get inflation below management.

Japan’s Prime Minister Fumio Kishida mentioned after a three-way assembly between the nation’s authorities, banking regulator and central financial institution that the talks had been held as a part of efforts to intently watch any affect on monetary system stability.

“Japan’s monetary system stays steady as a complete,” Kishida instructed a information briefing.

Singapore, Australia and New Zealand additionally mentioned they had been monitoring monetary markets however had been assured their native banks had been nicely capitalised and capable of face up to main shocks.

Whereas capital stays ample, analysts say a A$300 billion ($201 billion) refinancing job for Australia’s greatest banks is about to get tougher, as urge for food for brand spanking new debt shrinks.

Reporting by Pete Schroeder and Chris Prentice in Washington, Nupur Anand in New York, Tom Westbrook and Rae Wee in Singapore, Scott Murdoch in Sydney, Noel Randewich in Oakland, California, Balazs Koranyi, Francesco Canepa and John O’Donnell in Frankfurt, John Revill in Zurich; Writing by Deepa Babington, Sam Holmes and Alexander Smith; Enhancing by Sonali Paul and Kirsten Donovan

: .