(Bloomberg) — China criticized expanded US restrictions on its entry to semiconductor expertise, saying they’ll hurt provide chains and the world economic system.

Most Learn from Bloomberg

President Joe Biden administration introduced the export curbs on Friday, escalating tensions between the 2 international locations and including problems for an business confronted with slumping demand.

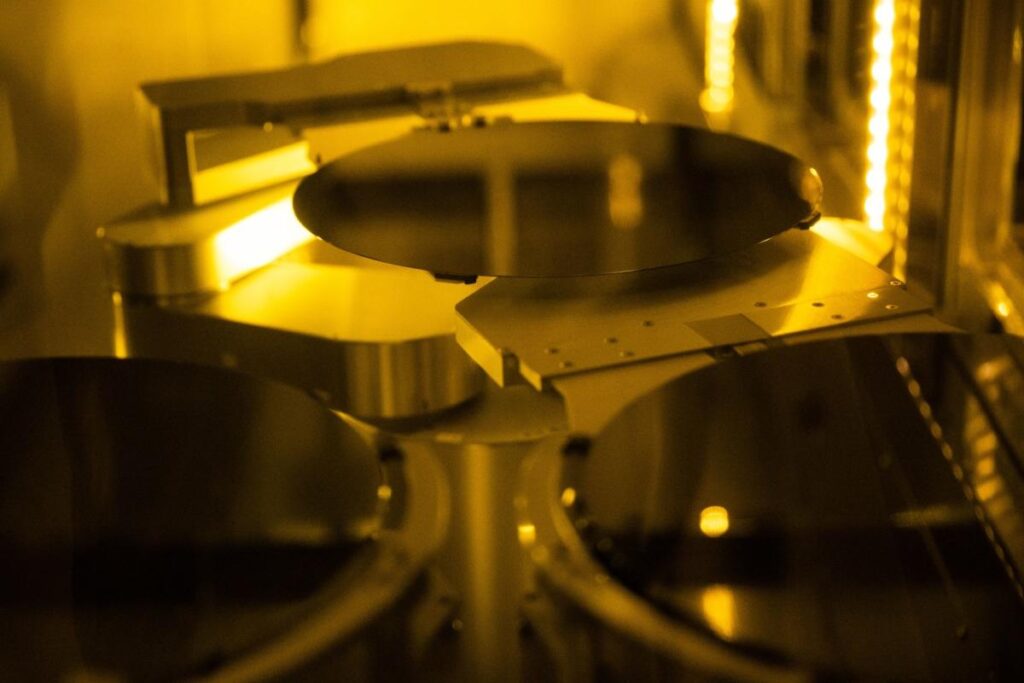

The measures search to cease China’s drive to develop its personal chip business and advance its navy capabilities. They embody restrictions on the export of some kinds of chips utilized in synthetic intelligence and supercomputing and tighten guidelines on the sale of semiconductor manufacturing gear to any Chinese language firm.

China “has poured assets into growing supercomputing capabilities and seeks to grow to be a world chief in synthetic intelligence by 2030,” stated Assistant Secretary of Commerce for Export Administration Thea D. Rozman Kendler. “It’s utilizing these capabilities to watch, observe and surveil their very own residents, and gasoline its navy modernization.”

Chinese language Overseas Ministry spokesperson Mao Ning stated Saturday that the measures, which start to enter into power this month, are unfair and can “additionally damage the pursuits of US firms,” in line with an official briefing transcript. They “deal a blow to international industrial and provide chains and world financial restoration,” she stated.

The US is in search of to make sure that Chinese language firms don’t switch expertise to the nation’s navy and that chipmakers in China don’t develop the aptitude to make superior semiconductors themselves.

The foundations come at a tough time for the chip business, which is struggling a steep drop in demand for personal-computer and smartphone parts. Shares of lots of the world’s greatest semiconductor makers tumbled on Friday following stories that the hunch could also be even worse than thought.

The federal government’s actions add one other layer of uncertainty for traders already making an attempt to work out how a lot demand for semiconductors would possibly shrink. Corporations akin to Utilized Supplies Inc. and Intel Corp. can’t simply stroll away from China, the most important single marketplace for their merchandise and a key a part of a worldwide provide chain for electronics used in every single place on the planet.

Chipmaker shares have struggled all through 2022, following three straight years the place the group climbed between 40% and 60%. The Philadelphia Inventory Trade Semiconductor Index is down almost 40% to date this yr, on observe for its greatest annual drop since 2008, and it just lately fell to its lowest degree since November 2020.

Widespread Losses

The losses have been widespread, with almost each element of the business benchmark index in unfavourable territory this yr. Nvidia Corp. and Superior Micro Units Inc. have declined virtually 60%. AMD reported preliminary third-quarter income on Thursday that was weaker than anticipated. AMD and Nvidia have already disclosed that the China-related restrictions on AI chips will damage their gross sales.

Nvidia stated Friday that the broader rules gained’t have “a cloth influence on our enterprise,” which is already restricted by earlier export controls.

When the brand new guidelines come into power, it will likely be tougher for suppliers of chips utilized in Chinese language supercomputers and associated gear to get permission to fill orders. They need to presume requests shall be denied, in line with senior Commerce Division officers.

Commerce additionally put a raft of restrictions on supplying US equipment that’s able to making superior semiconductors. It’s going after the kinds of reminiscence chips and logic parts which might be on the coronary heart of state-of-the artwork designs.

Whereas there shall be extra latitude for abroad firms needing expertise for their very own operations in China — or for events that may show they’re making issues there for rapid export elsewhere — Commerce stated it’ll implement the principles and in addition minimize off help for current deployments of equipment coated by the restrictions.

Whereas the US is residence to the most important block of firms that design very important digital parts and supply the advanced equipment to fabricate them, different areas have capabilities that would undermine a few of the authorities’s efforts.

Commerce Division officers acknowledged that abroad cooperation is important to keep away from hampering the initiatives and stated there are talks with different events underway world wide on the subject.

Chipmaking gear restrictions cowl manufacturing of the next:

-

Logic chips utilizing so-called nonplanar transistors made with 16-nanometer expertise or something extra superior than that. Typically talking, the smaller the nanometers, the extra succesful the chip.

-

18-nanometer dynamic random entry reminiscence chips.

-

Nand-style flash reminiscence chips with 128 layers or extra.

For firms with vegetation in China, together with non-US corporations, the principles will create extra hurdles and require authorities signoff.

South Korea’s SK Hynix Inc. is likely one of the world’s largest makers of reminiscence chips and has services in China as a part of a provide community that sends parts world wide.

“The brand new measures limit sale of kit for reminiscence merchandise of sure degree of expertise or above, however enable Korean chipmakers to export if they’ve a license from the Commerce Division,” the corporate stated in a press release. “SK Hynix is able to make its utmost efforts to get the US authorities’s license and can carefully work with the Korean authorities for this.”

Individually, Commerce added extra names to an inventory of firms that it regards as “unverified,” which means it doesn’t know the place their merchandise find yourself getting used. The 31 additions are all Chinese language. That signifies that US suppliers will face new hurdles in promoting applied sciences to these entities.

The most important identify to be added to the record is Yangtze Reminiscence Applied sciences Co. The memory-chip maker is broadly considered being one of the best guess China has of breaking by way of into the entrance ranks of the business and has made progress with superior merchandise for chip-based storage.

The US chip business has expressed concern that transferring too aggressively may put home firms at an obstacle. They fear that shedding China gross sales will damage their capacity to spend on innovation and probably assist rivals overseas.

The Semiconductor Business Affiliation, which represents all the largest US chipmakers, stated it’s evaluating the influence of the brand new export controls and can guarantee compliance.

A invoice signed by Biden in August guarantees to infuse about $52 billion into the US semiconductor business.

(Updates with response from Chinese language international ministry in sixth paragraph.)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.