Nvidia’s (NVDA) ultra-bullish development within the first half of the yr has paused, with the inventory failing to achieve new peaks over the previous few months. Following the extremely anticipated Q2 earnings report on the finish of August, Nvidia inventory skilled a pullback attributable to elevated investor expectations for hypergrowth, regardless of the robust outcomes it posted. I imagine this value correction presents a compelling alternative. On this article, I’ll define 5 causes for my bullish view on Nvidia, specializing in robust income progress (regardless of powerful comps), AI dominance, valuation, technical indicators, and Wall Road analyst consensus.

Let’s dive in.

1. Nvidia’s Robust Income Development Regardless of Robust Comparisons

The primary level supporting a chronic bullish thesis for Nvidia is the strong income progress demonstrated in its Q2 outcomes, regardless of difficult comparisons.

Nvidia posted 122% year-over-year progress in the newest quarter, reaching revenues of $30 billion—a outstanding achievement given the corporate’s already substantial income base. Though this progress charge is decrease than the 200% surge from the earlier quarter, absolutely the triple-digit top-line progress stays spectacular. This underscores Nvidia’s potential to scale its income considerably even when set towards it’s prior efficiency.

Whereas the post-Q2 inventory pullback could be attributed to expectations being set too excessive, it’s essential to notice that Nvidia continues to ship sequential quarterly income progress, signaling sturdy demand for its merchandise, particularly in AI and knowledge facilities. This stage of sustained progress at such a big scale highlights Nvidia’s capability to seize market share and drive long-term income growth. Nvidia’s Q3 gross sales steerage of $32.5 billion additional displays the corporate’s confidence in sustaining its progress trajectory.

2. Nvidia’s Dominance in AI and Information Heart Market

The second bullish level is Nvidia’s continued dominance within the knowledge middle GPU house, the place it holds a 98% market share on this quickly rising sector, in accordance with HPCwire.

Demand for AI-driven options is booming throughout industries, with Nvidia’s H100 Hopper GPU turning into essential for enterprise cloud purposes that require huge computing energy. Past {hardware}, Nvidia dominates AI via its software program ecosystem, together with CUDA and cuDNN, providing a complete AI resolution. As highlighted in Nvidia’s earnings name, the corporate goals to remodel the $1 trillion knowledge middle market by shifting from conventional to accelerated computing utilizing superior knowledge processing libraries.

Wanting forward, Nvidia plans to launch its Blackwell structure in This fall of Fiscal 2025, providing higher energy and effectivity than Hopper. Designed to fulfill the calls for of hyperscalers and AI builders, Blackwell will present complete options, together with chips, methods, networking, and software program. This launch is a key catalyst that may additional solidify Nvidia’s management in AI.

3. Nvidia Seems Attractively Priced When Adjusted for Development

The third level issues Nvidia’s valuations. At first look, its P/E ratio of 54.7x and ahead P/E of 42.5x could seem excessive, particularly in comparison with the semiconductor trade common of 23.7x. Nonetheless, my bullish stance is strengthened by Nvidia’s progress prospects, with the corporate anticipated to attain 106% income progress and 119% EPS progress this yr.

Moreover, analysts anticipate Nvidia’s EPS to develop at a CAGR of 36.6% over the subsequent three to 5 years. This spectacular progress charge, mixed with the present ahead P/E, leads to an inexpensive ahead price-to-earnings-to-growth (PEG) ratio of 1.16.

Historically, undervalued shares have a PEG ratio under one, but NVIDIA’s PEG ratio is extra favorable than these of all different Magnificent 7 shares. Amongst this group, Alphabet (GOOGL) and Meta (META) have the subsequent lowest PEG ratios at 1.28 and 1.48, respectively. Whereas this doesn’t essentially imply NVIDIA is undervalued in comparison with its Huge Tech friends, it does recommend that, in accordance with this metric, the inventory doesn’t seem overly costly.

4. NVDA’s Shifting Averages Recommend a Bullish Development

The fourth level reinforcing the bullish thesis is carefully tied to the sentiment surrounding Nvidia’s inventory efficiency. Regardless of current fluctuations, the corporate’s triple-digit income progress signifies that it’s nonetheless in a hypergrowth part. Nonetheless, with a staggering 2,700% inventory value surge over the previous 5 years, issues a few potential bubble stay.

On this context, I imagine that specializing in long-term shifting averages is important for gauging momentum. This offers a clearer view of Nvidia’s development amid each day volatility, particularly given the inventory’s 48% annualized volatility. NVDA inventory’s upward development is supported by a present buying and selling value above its 200-day shifting common of $92.80.

5. Wall Road Stays Overwhelmingly Bullish on NVDA

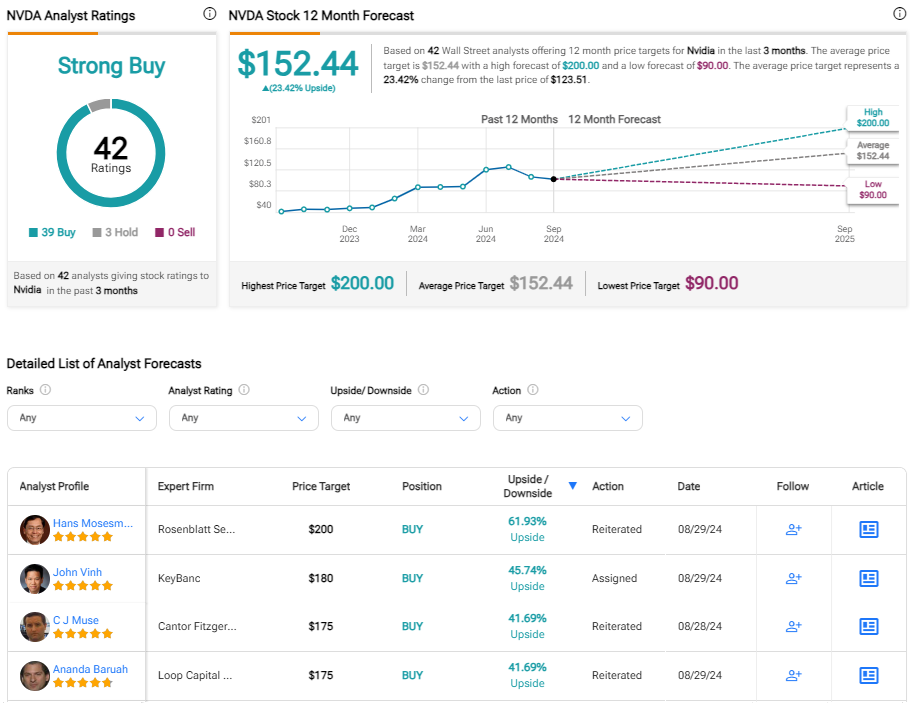

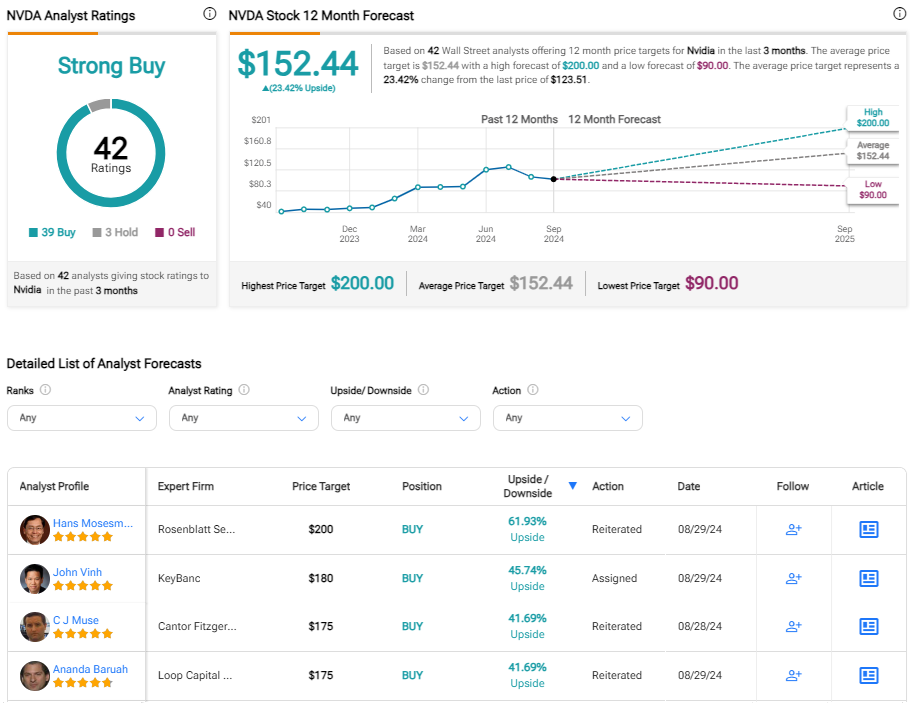

Lastly, the fifth level contributing to my favorable outlook for Nvidia is the overwhelmingly bullish consensus amongst Wall Road analysts. Of the 42 analysts masking the inventory, 39 have issued Purchase suggestions, whereas the remaining three have a Maintain score. Furthermore, the typical value goal amongst these analysts is $152.44, indicating potential upside of almost 25%.

A standout is Rosenblatt analyst Hans Mosesmann, who has the best value goal on Wall Road for Nvidia at $200 per share. His optimism continued after the Q2 outcomes, which he deemed robust, pushed by progress in Hopper AI and networking. Though gross margins dipped barely attributable to updates on Blackwell chips geared toward bettering yields, Mosesmann stays assured. He highlights that regardless of potential short-term weak spot within the share value, the bullish sentiment is supported by a 44x P/E a number of primarily based on Fiscal 2027 EPS.

Conclusion

On this article, I’ve outlined 5 key factors supporting my Purchase stance on Nvidia. I imagine that the inventory’s current weak spot presents a lovely shopping for alternative for traders desperate to capitalize on its robust progress trajectory.

Whereas some short-term hiccups might persist, Nvidia’s Q2 outcomes recommend that its progress story is ready to proceed robustly as the corporate consolidates its market dominance and prepares for the upcoming launch of the Blackwell structure. Given the potential for additional progress within the coming years, the present wealthy valuation could be justified, and Wall Road believes the identical.

Disclosure

Disclaimer