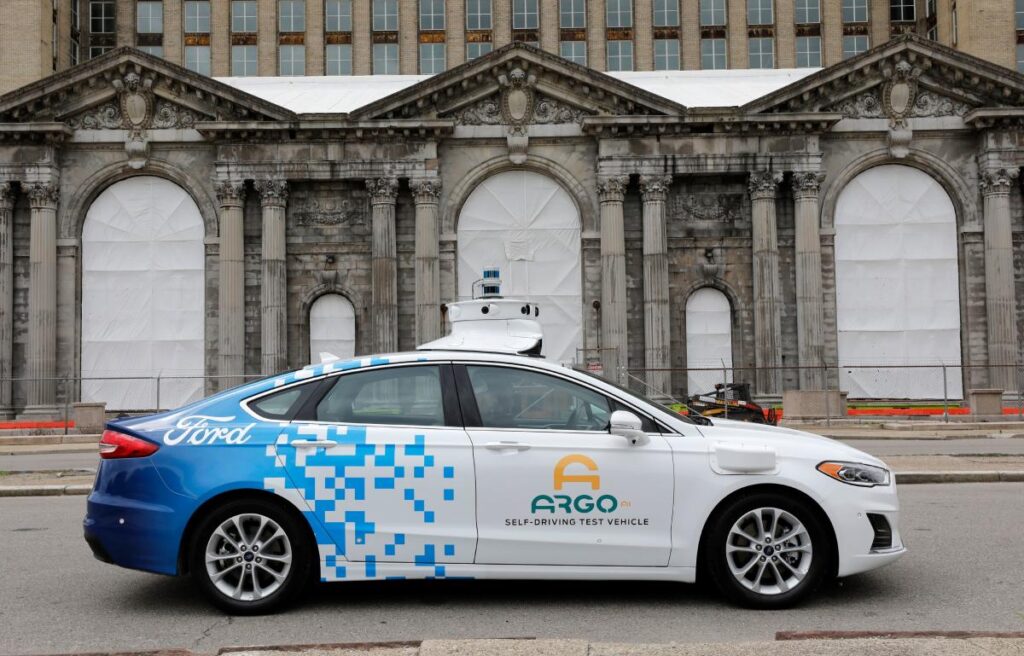

The driverless tech business hit a few snags this week.

First got here information in Ford’s (F) Q3 earnings report that the automaker was shutting down its Argo AI autonomous driving three way partnership. Ford mentioned it might be taking a $2.7 billion non-cash, pretax impairment on its funding in Argo AI, with engineers and different staff being absorbed by Ford and its Argo AI associate, Volkswagen. Volkswagen mentioned it might take a $1.9 billion cost from the winding down of Argo.

Then Reuters reported that the Justice Division started a legal probe final yr wanting into a number of crashes involving Tesla’s Autopilot driver help system, which was activated throughout these accidents, and whether or not Tesla made fraudulent claims about its driver help expertise’s capabilities.

Argo AI and Tesla have been each pursuing the purpose of Degree 4 and Degree 5 driving automation — whereas utilizing completely different methods to get there. Argo AI labored with authorities and stakeholders like bicycle owner and pedestrian security organizations to assist form its product, whereas Tesla made its customers and even the open roads of the U.S. its beta testing playground.

In any case, “it’s develop into clear it’s going to take longer than what traders actually needed to listen to,” Philip Koopman, Carnegie Mellon affiliate professor and self-driving skilled, instructed Yahoo Finance.

Doug Area, Ford’s chief product and tech officer, mentioned throughout the firm’s earnings name this week that stage 4 self-driving “goes to be a extremely powerful drawback to unravel.” Area, a former long-time Tesla engineer, added that the duty can be “the hardest drawback of our era.”

Ford mentioned its struggles with creating fully-autonomous Degree 4 and Degree 5 tech was each a capital and expertise difficulty, that means the automaker didn’t know the way a lot capital and expertise it might want to unravel the issue. In the end, the price was one thing that Ford and Volkswagen have been unwilling to bear.

“Once we regarded on the enterprise alternative right here, we noticed that the arc to a scaled, worthwhile enterprise was a great distance off — 5 years-plus out,” John Lawler, Ford CFO mentioned to Yahoo Finance this week about Degree 4 and Degree 5 autonomous providers. “[Ford technologists] consider there’s quite a lot of hurdles that should be crossed.”

Koopman surmised that the business is now centered on deployment fashions like middle-mile trucking — ie, autonomous trucking on highways solely — in addition to L2 and L3 assisted driving expertise that Ford is now specializing in.

“[Argo] was taking security actually critically, it is a good factor,” Koopman mentioned. “However for the business general, we’ve been seeing the business shift away from robotaxis in direction of different deployment fashions.”

Huge valuations, larger losses

Automakers have spent near $75 billion creating autonomous expertise, although there may be not a lot there to indicate for it but.

So what occurred to an business that UBS mentioned would have a complete addressable market price near $2.8 trillion by 2030?

Nobody appeared to completely value within the challenges — from a technological, capital sources, and coverage perspective — that might make the self-driving puzzle so laborious to unravel.

Wall Avenue is now assessing that the promise of autonomous driving is simply too far off and is valuing the tech accordingly. Intel’s spin off and IPO of its Mobileye autonomous tech unit just lately garnered a $16 billion valuation after being valued at $50 billion a yr in the past.

On the identical time, some corporations are clear-eyed in regards to the funding required.

“[Self-driving startup] Waymo shouldn’t be on the mercy of an OEM (unique gear producer); Google [Waymo’s owner] can afford to make a 10-year guess, and the OEM’s simply will not be comfy with that type of burn fee on that type of timeframe, ” Koopman says. ”[GM-owned] Cruise goes to depend upon how a lot endurance GM has.”

As for Tesla, CEO Elon Musk just lately doubled down on his firm’s capacity to unravel the Degree 4/Level5 drawback.

“You are going to have nobody within the automotive by the top of this yr,” Musk mentioned on the corporate’s most up-to-date earnings name. “And definitely, and not using a query, that is no matter is in my thoughts subsequent yr,” he mentioned. “I believe we’ll even have an replace subsequent yr to have the ability to present to regulators that the [self-driving] automotive is safer, a lot so than the common human.”

Nevertheless, with regulators just like the DOJ, SEC, and the NHTSA investigating dozens of crashes involving Tesla’s self-driving software program, there may be some uncertainty as to when Tesla can absolutely launch its Degree 4 / Degree 5 platform.

“The place’s the distinction between puffery and fraud? I don’t know,” Koopman mentioned, describing it as a authorized query for attorneys and the DOJ.

Authorized points apart, Koopman defined, there isn’t a lot in the way in which of what a regulator can do when a allow is requested for the deployment or stay part past approving the allow if the testing part has gone easily. As soon as it’s stay or in deployment, like Waymo and Cruise are in California, regulators can monitor efficiency for issues of safety.

“There is no such thing as a regulatory hurdle to Tesla aside from truly getting their expertise to work,” Koopman mentioned.

—

Pras Subramanian is a reporter for Yahoo Finance. You may observe him on Twitter and on Instagram.

Click on right here for the most recent trending inventory tickers of the Yahoo Finance platform

Click on right here for the most recent inventory market information and in-depth evaluation, together with occasions that transfer shares

Learn the most recent monetary and enterprise information from Yahoo Finance

Obtain the Yahoo Finance app for Apple or Android

Observe Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube