Lots of people appear to care about inventory splits, a lot in order that we actually have a devoted calendar for them at The Motley Idiot. An enormous cut up is developing for Chipotle Mexican Grill (NYSE: CMG), which is doing a 50-to-1 alternate, estimated to happen on June 26. Traders have gotten excited and despatched shares of Chipotle near all-time highs at round $3,000 a share.

I’m right here to let you know that inventory splits do not matter. A inventory is well worth the future money it’ll distribute again to shareholders, discounted again to right now. For Chipotle, it’s irrelevant whether or not it has one share that trades at a value of $80 billion (its present market capitalization) or 80 billion shares buying and selling for $1. An investor will generate profits if the corporate generates extra in earnings.

Forgetting the irrelevant inventory cut up, how does Chipotle stack up when doing elementary evaluation? Do you have to purchase the inventory at present costs? Let’s take a more in-depth look and discover out.

A number of room for retailer depend development

Because the premier fast-casual restaurant chain for Mexican grub, Chipotle now has 3,437 retailer models, principally in the USA. Over the long run it plans to open 7,000 shops in North America, and it’s beginning to dip its toe into worldwide markets. Particularly, it has a couple of shops opened in Western European markets, and simply launched a partnership to deliver Chiptole to Dubai and the Center East.

Whereas it’s unclear what number of areas Chipotle plans to construct internationally, I feel it’s cheap for the corporate to hit a couple of thousand in some unspecified time in the future over the subsequent decade or two, particularly if it strikes to different markets reminiscent of Australia. That may deliver it to a complete addressable market of not less than 10,000 eating places, which I do not assume is loopy. McDonald’s, for reference, has over 40k areas worldwide.

How a lot would this imply in gross sales? As we speak, the typical Chipotle generates $3 million in annual gross sales, a quantity that has grown at a single-digit charge lately as the corporate retains up with inflation. Ultimately, Chipotle ought to hit a median restaurant gross sales degree of $3.5 million. Apply that to 10,000 areas and you’ve got $35 billion in annual gross sales in comparison with $10 billion right now. In fact, there are various years of development wanted to hit these gross sales figures, however Chiptole has a transparent line of sight to reaching these development targets.

Can revenue margins preserve transferring greater?

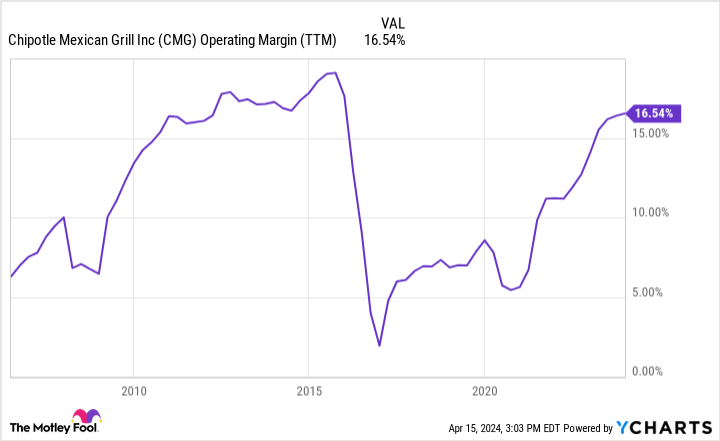

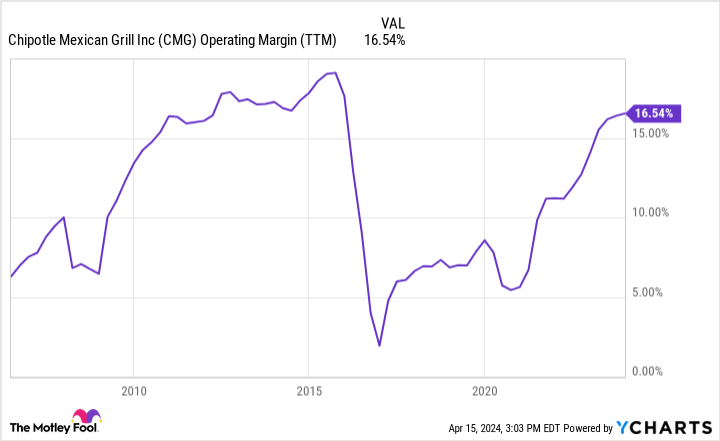

Okay, we now have some estimates on Chipotle’s gross sales potential. Now let’s transfer to what actually issues to buyers: income. Chipotle has carried out an ideal job lately to increase its working margin, recovering again to 16.5% within the final 12 months. It has taken nearly 10 years for the corporate to recuperate from its food-borne illness outbreak, when revenue margins have been pushing towards 20%.

Over the long run, buyers ought to count on some small ranges of working leverage as Chipotle additional scales across the globe. Do not increase huge margins from a restaurant idea, although. There’ll at all times be main labor and meals prices for Chipotle, which can doubtless preserve its revenue margins within the 15%-20% vary.

Assuming Chipotle can hit an 18% consolidated margin at its $35 billion future gross sales estimate at 10k areas, the corporate might be producing $6.3 billion in annual income in some unspecified time in the future down the road.

Don’t fret a few inventory cut up, deal with valuation

Once more, buyers should not fear a few 50-to-1 inventory cut up for Chipotle. It has no bearing on the intrinsic worth of Chipotle, how many individuals are going to go to its shops, or any of its enter prices. What issues is how a lot it’ll earn in money for shareholders within the coming years.

I feel Chipotle can generate over $6 billion in earnings as soon as it hits 10,000 areas. At a present market cap of $80 billion, that might give Chipotle inventory a cheap-looking price-to-earnings a number of (P/E) of 13. The issue is that it’ll take Chipotle a few years to succeed in this earnings degree. Even when it ups its retailer opening charge to 400 a 12 months (it opened 271 in 2023), it’ll take Chipotle over 16 years to succeed in 10,000 areas worldwide.

This isn’t an in a single day development story like Nvidia. Chipotle is an effective enterprise, however one the place 10-plus years of earnings development is already priced in. Neglect the inventory cut up — this is the reason you need to keep away from shopping for shares of Chipotle inventory. The inventory is overvalued proper now and prone to disappoint buyers who purchase right now.

Do you have to make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Chipotle Mexican Grill wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $526,933!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 15, 2024

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Nvidia. The Motley Idiot has a disclosure coverage.

Time to Purchase Chipotle Earlier than Its Large Inventory Cut up? was initially revealed by The Motley Idiot